To open long positions on GBP/USD, you need:

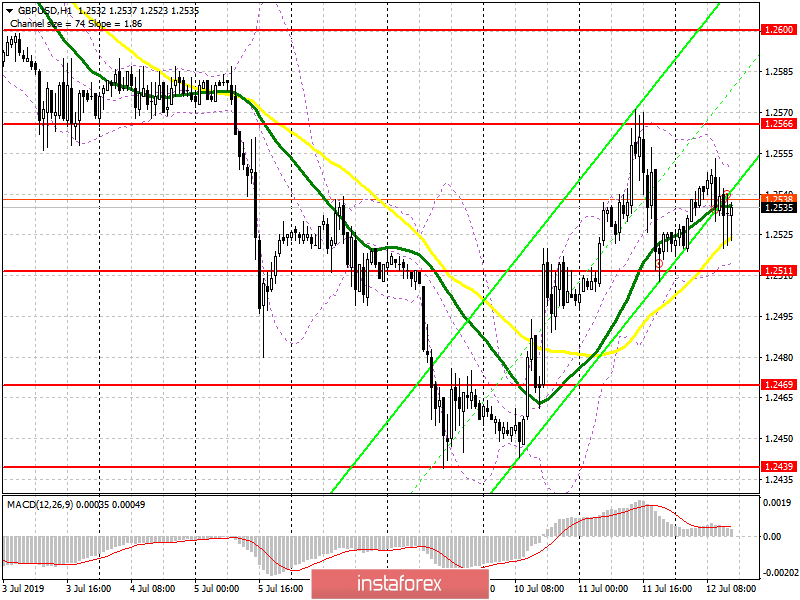

From a technical point of view, nothing has changed in the morning. To maintain the bullish market, buyers need a breakout and consolidation above the resistance of 1.2566, which will lead to an update of the highs in the area of 1.2600 and 1.2639, where I recommend taking the profits. In the case of a downward correction scenario in the second half of the day, long positions can be returned on a false breakdown from the support of 1.2511, as well as to a rebound from a larger minimum in the area of 1.2469.

To open short positions on GBP/USD, you need:

Pound sellers will expect a false breakdown in the resistance area of 1.2566, which will form a new upper limit of the downward channel. However, the main task of the bears will be to break through and consolidate the support of 1.2511, which will push GBP/USD to the area of the lows of 1.2469 and 1.2439, where I recommend taking the profits. With further growth above 1.2566, it is best to take a closer look at the short positions on the test of highs of 1.2600 and 1.2639.

Indicator signals:

Moving Averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates market uncertainty.

Bollinger Bands

In the case of the GBP/USD decline in the second half of the day, the support will be provided by the lower limit of the indicator around 1.2510.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20