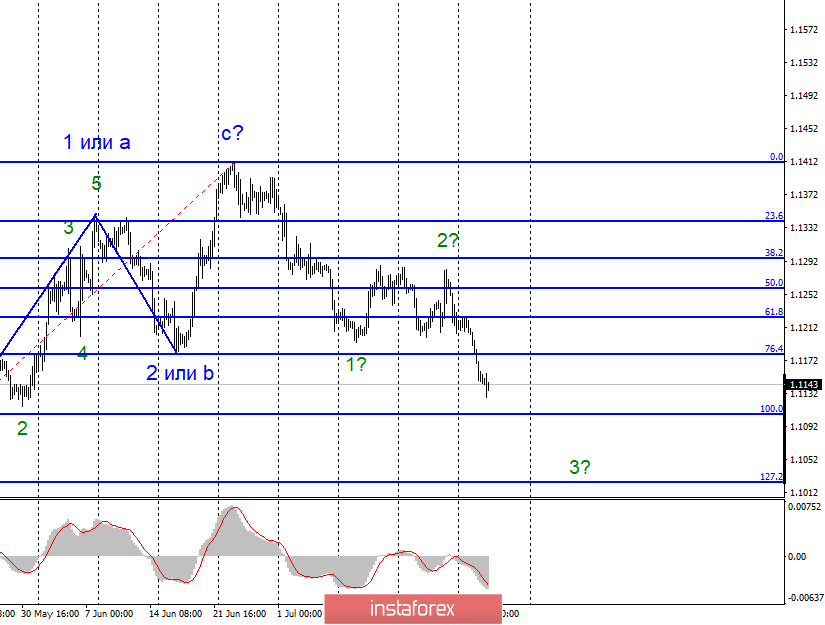

EUR/USD

On Tuesday, July 23, the EUR/USD pair ended with a decrease of 60 basis points. Quite unexpectedly, given that the news background for the pair was absent yesterday. No interesting news has been received, but the markets still found grounds for another purchase of the US dollar. Business activity in Germany in the manufacturing sector fell to 43.1, in the services sector to 55.4, and the composite index of business activity fell to 51.4. In the European Union, the situation is no better: in the manufacturing sector, business activity fell to 46.4, in the service sector – to 53.3, and the composite index – to 51.5. The only thing that at least slightly smoothes the effect of such weak economic data is the incompleteness of the values for July. That is, at the end of the month, business activity can be clarified and, accordingly, be higher than now. However, in the current realities of the euro, it should be feared that it was not even lower than it is now. But such a news background fully fits into the current wave layout, involving the construction of a downward trend section.

Purchase targets:

1.1412 – 0.0% according to Fibonacci

Sales targets:

1.1106 – 100.0% according to Fibonacci

1.1025 – 127.2% according to Fibonacci

General conclusions and trading recommendations:

The euro/dollar pair confirms its readiness to build a downward trend segment. The breakthrough of the minimum of the assumed wave 1 indicates the readiness of the instrument to build a downward wave 3. Thus, I recommend selling the pair with targets located near 1.1106 and 1.1025, which is equal to 100.0% and 127.2% of Fibonacci.

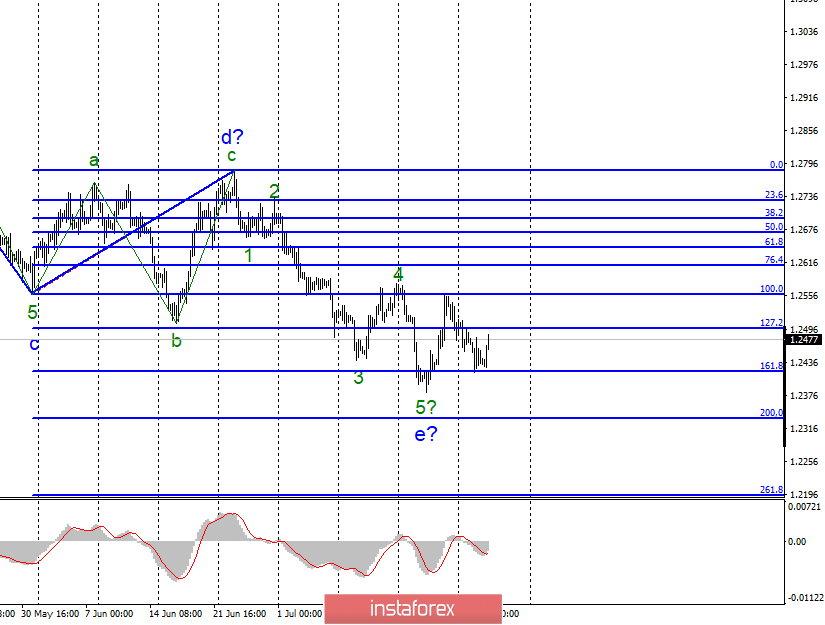

GBP/USD

The GBP/USD pair fell by 40 basis points on July 23, and today, after an unsuccessful attempt to break the Fibonacci level of 161.8%, it began to grow. And it also fully fits into the current wave pattern, which involves the construction of an upward trend segment, at least corrective. All the attention of the markets yesterday was focused on the results of the election of the Prime Minister in the UK, and the victory was won very predictably by Boris Johnson. Now, he has to perform a huge layer of work, as his election promises imply the country's exit from the EU on October 31. As it will make the new Prime Minister, while it is difficult to assume, given the reluctance of Parliament to implement a hard Brexit. Perhaps there will be re-elections to the Parliament, it may be a referendum. In any case, the news background is still not in favor of the pound sterling. The current rise of the pound/dollar instrument may be short-lived.

Sales targets:

1.2334 – 200.0% according to Fibonacci

1.2194 – 261.8% according to Fibonacci

Purchase targets:

1.2783 – 0.0% according to Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound/dollar instrument involves the completion of the construction of the downward wave e. Thus, I recommend small purchases of the pair with targets placed near 28 figures and with an order that limits losses under the minimum of wave e, after the MACD signal goes up. I recommend returning to sales not earlier than a successful attempt to break the minimum of the wave e.