Today's data on the eurozone indicate a decline in industrial production, which is clear evidence of a looming recession. Given the fact that the eurozone manufacturing sector has been in a bad state before, and is now even worse, this increases the risk of a technical recession, which will clearly make the European Central Bank think even more about the monetary policy course that will be announced tomorrow.

Perhaps the only country where the purchasing managers index (PMI) for the manufacturing sector remained above 50 points was France.

According to the report, the preliminary index of supply managers for the production sector in France in July fell to a neutral level of 50.0 points, while the decline was projected at 51.5 points. Back in June, the index was 51.9 points.

The preliminary index of supply managers for the French service sector in July was 52.2 points, while economists had forecasted it at 52.6 points.

As for the mood in the business community in France, they fell in July. According to the report, the index fell to 101 points against 102 points in June. The index was forecasted unchanged.

As mentioned above, Germany's manufacturing sector is clearly in recession, and this is confirmed by the data published today by the statistics agency. The report indicates that the preliminary purchasing managers index (PMI) for the manufacturing sector in Germany in July fell even more, to 43.1 points, against 45.0 points in June. Economists had expected the index at 45.0 points. The weak manufacturing sector suffers from a sharp slowdown in external orders and is kept afloat only by the domestic market. Trade wars and the decline in global economic growth are also exerting serious pressure.

As for the service sector in Germany, the preliminary purchasing managers index (PMI) in July amounted to 55.4 points against 55.8 points in June and the forecast decline to 55.3 points.

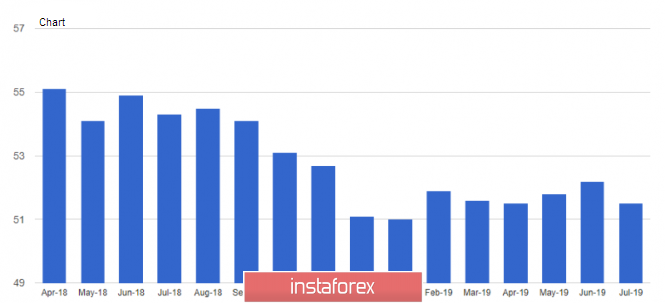

All of these reports from IHS Markit resulted in one overall indicator for the eurozone, where the preliminary composite PMI of the eurozone in July fell to 51.5 points from 52.2 points in June, while economists had expected the index to be 52.1 points. Even considering the fact that the index is preliminary, it will be enough to strengthen the desire of central bank managers to soften the policy.

Data on lending to companies in the euro area were ignored by the market, even despite the decline in the growth of the money supply.

According to a report by the European Central Bank, lending to companies in the eurozone in June 2019 increased by 3.8% compared to the same period in 2018. Household lending rose 3.3% in July. The eurozone's m3 monetary aggregate rose only 4.5% in June after rising 4.8% in May, while economists had expected a growth of 4.7%.

Tomorrow's decision of the European regulator is unlikely to please traders, although this can be seen in the market and the European currency, which is losing its position against the US dollar.

As for the technical picture of the EURUSD pair, the prospects for risky assets, before tomorrow's ECB meeting, remain quite gloomy. The bears have reached the support of 1.1160 and fixed below it. Now, their new goal will be to break the low of 1.1135, which will only increase the pressure on the trading instrument and push it to the next lows in the area of 1.1110 and 1.1080.