The main attention of traders today will be focused on the decision of the heads of the European Central Bank, on which the almost further medium-term trend of the European currency will depend. No one doubts that the European regulator will announce new measures to stimulate the economy following the US Federal Reserve and other central banks. The main question is how big and long the bond redemption program will be, and whether the ECB will go to lower interest rates in the autumn of this year.

Let me remind you that we are talking not only about the key interest rate but also about the deposit rate, which has already been at a negative level for quite a long time.

Many experts expect that at this meeting, the ECB is unlikely to make a decision on changing monetary policy, but will hint at it, focusing on the autumn of this year.

The main problem for the ECB to make such a decision is the economic downturn, the recession in the manufacturing sector, as well as low inflation, which suggests the ECB's intention to apply more aggressive stimulus measures than many experts expect.

Immediately after the decision of the central bank, a press conference of President Mario Draghi will take place. It is expected that he will confirm his promises, which were made in mid-June. Then the head of the ECB promised to take all measures to maintain economic growth and bring inflation closer to the target level.

Yesterday's data on the state of the US economy were ignored by traders.

According to a report by the US Department of Commerce, the growth in new home sales in the US accelerated in June, indicating enlightenment for the labor market, which has recently been experiencing some difficulties.

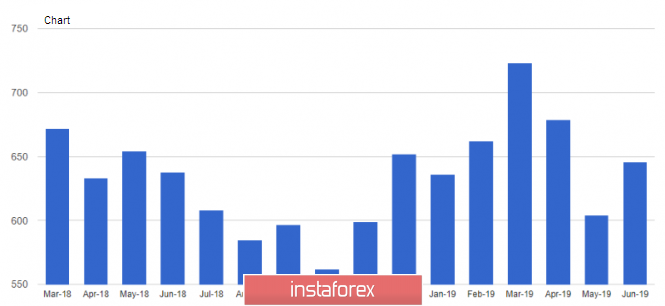

Thus, sales in the primary housing market in June increased by 7.0% and amounted to 646,000, while economists had expected that sales would amount to 659,000. The indicator is very volatile and depends on the period. The median price of a new home in June in the US was 310,400 dollars.

Business activity in the US private sector grew in July, which is also a good sign for the economy.

According to IHS Markit, the preliminary composite index of supply managers, which takes into account business activity, services and the manufacturing sector, rose to 51.6 points in July against 51.5 points in June.

If we take the breakdown of the index, the preliminary PMI index for the manufacturing sector fell to 50 points from 50.6 points in June. The preliminary index of PMI managers for the service sector, on the contrary, increased and amounted to 52.2 points against 51.5 points in June.

As for the current technical picture of the EURUSD pair, it remained unchanged, and it is unlikely that anything will change before the ECB meeting.

So far, the bearish momentum is restrained by the level of 1.1120, but its breakthrough will only worsen the situation of risky assets and lead to a further bearish trend with an exit to the lows of 1.1100 and 1.1040. If the speech of Mario Draghi will not be overwhelming, then a rebound of the euro up to the highs of 1.1180 and 1.1240 is not excluded.

GBPUSD

Traders do not know what to do with the British pound. On the one hand, the victory of Boris Johnson is a bearish signal, and on the other hand, his statements from yesterday to find a compromise with the EU and act in a way that would please everyone was not much liked by the sellers. Many expected harsher statements from him, which were not followed.

Now, we can count on new signals and see which side the market will choose, as the upward correction of the pound is long overdue, but there are no reasons for its formation yet.

Yesterday, Boris Johnson said that the UK plans to withdraw from the EU on October 31, and there will be no "ifs", and no "but". He also noted that he will try to reach a new agreement with the EU on the basis of the principles of free trade and mutual support, but if it is not possible to do this, then a plan will be developed in parallel to exit the EU without an agreement.

Johnson is also convinced that an agreement can be reached without a settlement of the Irish border, and the future partnership with the EU will be warm and sincere.

Important statements were made about the changes in the economy. The new Prime Minister plans this autumn to prepare a package of economic measures to support companies and investments, as well as to change the rules of taxation to support investment and research.