Sellers of the euro did not wait for the decision of the European Central Bank and after the release of a terrible index of business sentiment in Germany, they continued to get rid of risky assets. The ECB's decision to leave rates unchanged provided the euro only temporary support, after which sales resumed, but everything in order.

Data from the Ifo institute that the mood of the German business community in July this year continued to deteriorate, relished the sellers of the euro. A weak report once again confirms the fact that Germany's economy is gradually slowing down.

According to the report, the index of sentiment in the German Ifo business community in July fell to 95.7 points against the June value of 97.5 points, while economists had forecast the index at 97.0 points. The index of companies fell expectations to 92.2 points, against the June value of 94.0 points.

Ifo was quick to announce that a number of the companies surveyed have become less stable in the business, with skepticism concerning the future. Let me remind you that the report is based on the results of a survey of about 9,000 companies.

Problems are especially observed in the manufacturing industry index, which has shown one of the largest declines in recent years and is not expected to improve the position of the manufacturing industry in the short term.

As noted above, the euro rose after the ECB left rates unchanged, but the growth was short-lived.

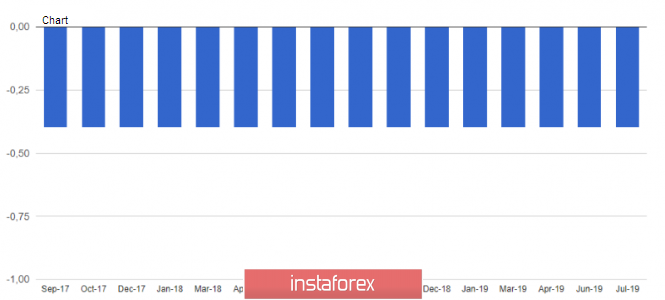

Today, it became known that the European Central Bank left the refinancing rate unchanged at 0.0%, as well as the deposit rate at -0.4%, which coincided with a number of forecasts of economists.

The ECB noted that it is ready to take the necessary measures to ensure that inflation meets the target level, and current rates will remain at current or lower levels until the end of the first half of 2020. The Central Bank also informed that it will consider possible options for advanced indication and purchases of assets.

The speech of the President of the European Central Bank, which is scheduled for the afternoon, can "shed light" on the future of monetary policy of the eurozone.

However, as for the current technical picture of the EURUSD pair, the bears have reached the expected weekly targets in the area of 1.1105, and most likely, they will start to take profit from there. Even the tough tone of Mario Draghi's statements will not be able to resume the downward movement in the pair. Large players will close their short positions on purchases from speculative traders, so do not expect a stronger decline even after Mario Draghi's statements on the topic of reducing interest rates, which everyone expects in the future.

Returning to the topic of negotiations between the US and China, some details became known.

Negotiations will resume on July 30. Lighthizer and Mnuchin will arrive in Shanghai and hold a series of meetings with Chinese Deputy Prime Minister Liu He. The negotiations will cover topics such as intellectual property, technology transfer, non-tariff barriers, as well as a number of other issues.

A number of supporters of a tough stance against the United States have already commented on future negotiations, calling on the United States to stop and not inflate the conflict, which only harms the two countries.