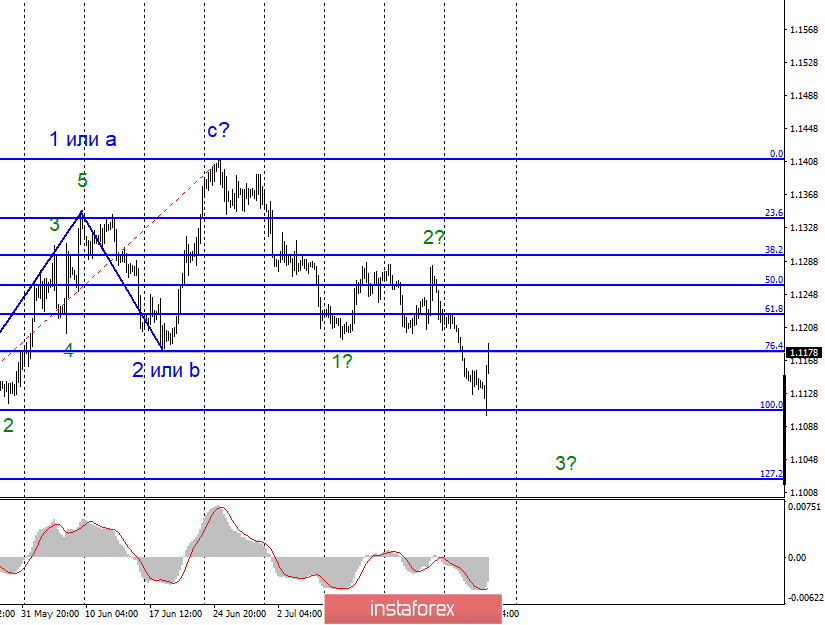

EUR/USD

On Wednesday, July 24, the EUR/USD pair ended with a decrease of only 10 basis points. Today, the currency market remained in a downward mood until the ECB announced that the deposit and credit rates remain at the same level at the moment. That is, there were no changes in monetary policy. This, on the one hand, is a positive point, and on the other, ECB Chairman Mario Draghi said that the rates will remain at the current level or below until mid-2020. This means that Mr. Draghi admits their reduction if the economic situation does not improve dramatically until the next meeting, which will be held in September. The ECB also notes low inflationary pressure and allows for an even greater decline in the consumer price index. Economic growth in the second and third quarters of 2019 will also slow down. Thus, I believe that the ECB gave the market more negative than positive, and the growth of the euro can be a short-term reaction and interpreted as a corrective wave in the future wave 3. The current wave layout continues to imply the construction of a downward trend. However, an unsuccessful attempt to break the Fibonacci level of 100.0% led to a departure of the euro/dollar pair from the achieved lows.

Purchases targets:

1.1412 – 0.0% according to Fibonacci

Sales targets:

1.1106 – 100.0% according to Fibonacci

1.1025 – 127.2% according to Fibonacci

General conclusions and trading recommendations:

The euro/dollar pair moved away from its lows amid the ECB meeting and its results. However, the downward mood in the forex market remains. Thus, I recommend selling the pair with targets located near the levels of 1.1106 and 1.1025, which is equal to 100.0% and 127.2% of Fibonacci, when the MACD signal is down.

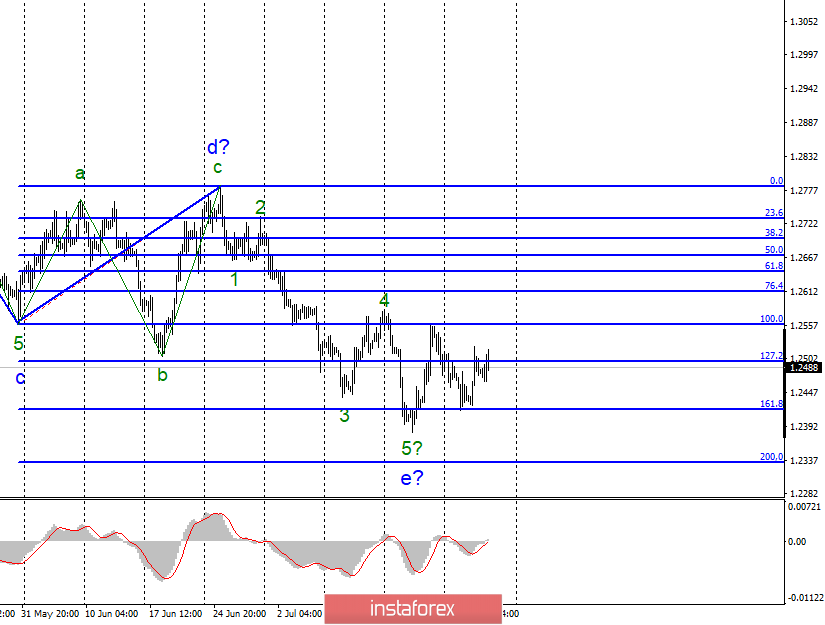

GBP/USD

The GBP/USD pair increased by 45 basis points on July 24, thus maintaining the integrity of the current wave marking, which implies the construction of at least three waves upwards. The news background still allows for some growth of the pound sterling, as the vector of market attention is shifted now towards the ECB, and next week, it will be shifted towards the Fed, which can lower the key rate. In the UK, while Boris Johnson officially took office as Prime Minister and will now take the first steps in his new post. Probably, we are waiting for a reshuffle among Ministers, and in his first speech, Johnson has already hinted at new negotiations with the European Union on agreements on Brexit and, in particular, the border between Ireland and Northern Ireland. Thus, it is possible that the negotiations will resume, because, despite all the slogans of Johnson during the elections that Brexit will be held on October 31 in any case, even if the hard option, the new Prime Minister understands that the UK economy could suffer serious losses in this case.

Sales targets:

1.2334 – 200.0% according to Fibonacci

1.2194 – 261.8% according to Fibonacci

Purchases targets:

1.2783 – 0.0% according to Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound/dollar tool involves the completion of the construction of the downward wave e. Thus, I recommend small purchases of the pair with targets placed over the mark of 1.2550 and with an order limiting losses under the minimum of wave e. I recommend returning to sales after a successful attempt to break through the minimum of wave e.