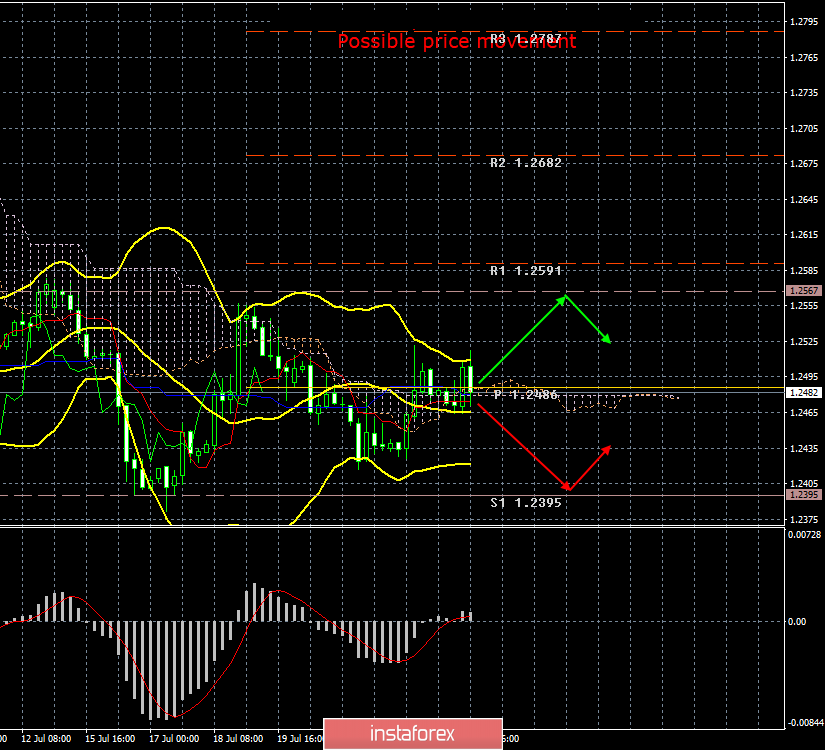

4-hour timeframe

The amplitude of the last 5 days (high-low): 134p - 80p - 58p - 64p - 96p.

Average amplitude for the last 5 days: 86p (82p).

No later than yesterday, Boris Johnson spoke for the first time as Great Britain's prime minister. In his speech, he unexpectedly stated that "there is a rather low probability that Brussels and London will not be able to agree on the terms of Brexit", clearly hinting at new negotiations with the European Union. We have repeatedly said that Boris Johnson's hopes may not come true, since his behavior and rhetoric is a bit like Donald Trump. Johnson changes his mind too often, makes overly loud statements, and his promises look too vain. The European Union, under Theresa May, made a statement that the current version of the "deal" is the best that it can offer Brussels, and there will be no revision of the agreements. However, Boris Johnson has managed to declare that he is going to conduct new negotiations with the EU, and at the same time he does not strive for a hard Brexit, but he does not fear it either. Recall that a couple of days ago, his rhetoric was "hard Brexit October 31 and nothing else." Today, in response to Johnson, a representative of the European Commission, Mina Andreeva, spoke, saying that they were following Johnson's speech in Parliament and did not want to comment on it, but could not speak about any new negotiations. Andreeva also added that residents and enterprises of Britain, rather than the 27 EU member states, will feel the greater effect of the hard Brexit. Thus, Johnson seems to have to implement Brexit without a "deal", but how can he convince Parliament to support this option? It seems that the whole saga of the "divorce process" will be delayed for many more months.

Trading recommendations:

The pound/dollar currency pair can resume the downward movement. Thus, it is now recommended to wait for the MACD indicator to turn down and consolidate the price below the Kijun-sen line and resume selling the pound in order to support the level of 1.2395.

After the pair has been consolidated above the critical line, it will be possible to buy the British currency, however, with extreme caution and small lots. The first goal is the level 1.2567.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen - the red line.

Kijun-sen - the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dotted line.

Chikou Span - green line.

Bollinger Bands indicator:

3 yellow lines.

MACD Indicator:

Red line and histogram with white bars in the indicator window.