To open long positions on EURUSD, you need:

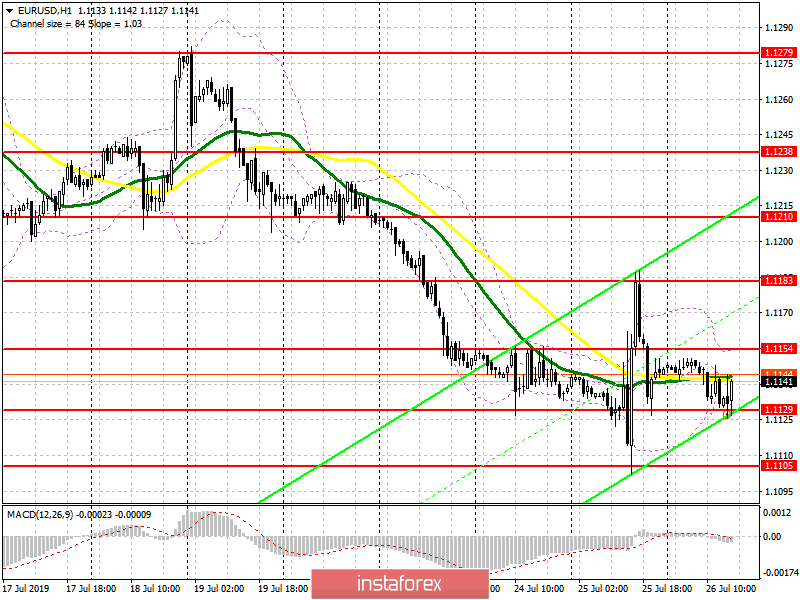

On the one hand, the US GDP report was better than economists' forecasts, and, on the other hand, pointed to a slowdown in the growth of the American economy in the 2nd quarter compared to the 1st, which put traders in a deadlock at the end of the week. At the moment, trading is conducted on the same side channel as in the morning. The breakout of the level of 1.1154 will be a signal to open long positions in the euro in order to continue the upward correction to the area of 1.1183 and to reach a new maximum of 1.1210, where I recommend taking the profit. In the meantime, the bulls managed to hold the pair above the support of 1.129, which retains a chance to continue yesterday's growth. While the decline in EUR/USD in the second half of the day, to the area of 1.1129 again, it is best to open long positions from there when forming a false breakdown. When breaking this range, it is best to buy the euro on a rebound at this week's low of 1.1105.

To open short positions on EURUSD, you need:

Bears will expect a further decline in the support area of 1.1129 and its breakthrough, as the consolidation below this level will give a new impetus to the downward trend, which will lead to new lows in the area of 1.1105 and 1.1079, where I recommend taking the profits. The formation of a false breakout in the resistance area of 1.1154 will also be a signal to open short positions in EUR/USD. In the case of the growth of the euro above the resistance of 1.1154, it is best to return to short positions on the rebound from the high of 1.1183 or from the level of 1.1210.

Indicator signals:

Moving Averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market.

Bollinger Bands

In the case of an upward correction, the upper limit of the indicator in the area of 1.1154 will act as a resistance.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20