At the start of the trading week, trading euro-dollar pair continues to trade in the area of annual minimums at the base of the 11th figure. Rather strong data on the growth of the American economy, as well as comments by Larry Cudlow about the commitment to the policy of a strong dollar, put strong pressure on the EUR/USD pair. While the single currency is only preparing to take a hit from the ECB in the form of monetary policy easing, the greenback has fully played a similar step by the Fed.

After the release of Friday's data, traders are not worried about the fact that the US regulator will go beyond the most expected scenario, which implies a "precautionary" interest rate cut of 25 basis points. However, the European Central Bank may apply a wider arsenal of available actions in September, depending on the dynamics of current macroeconomic statistics, which is why the releases expected this week will have a strong impact on EUR/USD pair. According to the results of the trading week-day, it will become clear whether the bulls will keep the pair above the 10th level or bears will first gain a foothold in the 10th figure. Secondly, they will mark a new price horizon for themselves in the region of the ninth figure already.

The economic calendar is full of events this week but except on Monday. Tomorrow, July 30, all the attention of traders will be focused on the release of data on the growth of German inflation. Considering the fact that on Wednesday we will find out the values of European inflation, these figures will play an important role. According to preliminary forecasts, the consumer price index in Germany will continue to grow minimally on a monthly basis (+ 0.4%) but will slow down in annual terms (+ 1.5% after rising to 1.6%). If these figures are worse than expected, the euro will be under considerable pressure in anticipation of the release of the European CPI.

During Tuesday's American session, interest will cause a major index of spending on personal consumption, which measures the core level of spending and indirectly affects the dynamics of inflation in the US. It is believed that this indicator is monitored carefully by members of the regulator. According to forecasts, the index will demonstrate a contradictory trend as it drops to 0.1% in monthly terms and it will rise to 1.7% in annual terms. In general, this release can have an impact on the dynamics of the pair only with strong fluctuations, when real figures differ significantly from the predicted values. However, the indicator of consumer confidence of Americans, which will also be published on Tuesday, will certainly attract market interest. The fact is that last month this index collapsed to two-year lows, putting strong pressure on the dollar. The July figures should demonstrate the recovery of the indicator (up to 125 points). Otherwise, dollar bulls may lose one of their "Trumps" in the context of restoring the main American indicators.

The key event on Wednesday is the July Fed meeting. On this day, we will learn the results of the two-day meeting of the members of the regulator. According to general market expectations, the Fed will cut rates to 2.25%. In general, this fact will not surprise anyone because of its wide announcement. Jerome Powell spoke about such intentions in Congress and later, his words were confirmed by many of his colleagues. As noted above, the market was worried about the use of more aggressive measures by the Fed, for example, about a rate cut by 50 points at once. However, recent macroeconomic reports (not only of GDP) leveled these concerns, especially against the background of ongoing US-China trade negotiations. That is why the outcome of the July meeting may support the dollar despite the actual easing of monetary policy.

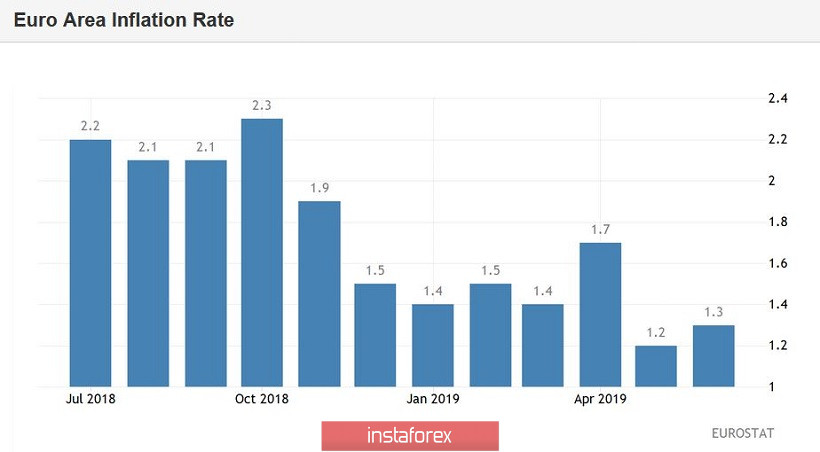

However, during the European session of the environment, the EUR/USD pair will focus on indicators of the state of the eurozone economy. We learn that the consumer price index, as well as a preliminary estimate of GDP, grew in the second quarter. European inflation should show negative dynamics as the overall index should fall to 1% and the core index to 0.9%. Eurozone GDP may also disappoint investors. According to the consensus forecast, the key indicator will fall to 0.2% q/q and 1% y/y. In this case, such a result will have a strong pressure on the euro as the European regulator can apply large-scale measures to mitigate monetary policy, including a reduction in the rate and the resumption of QE.

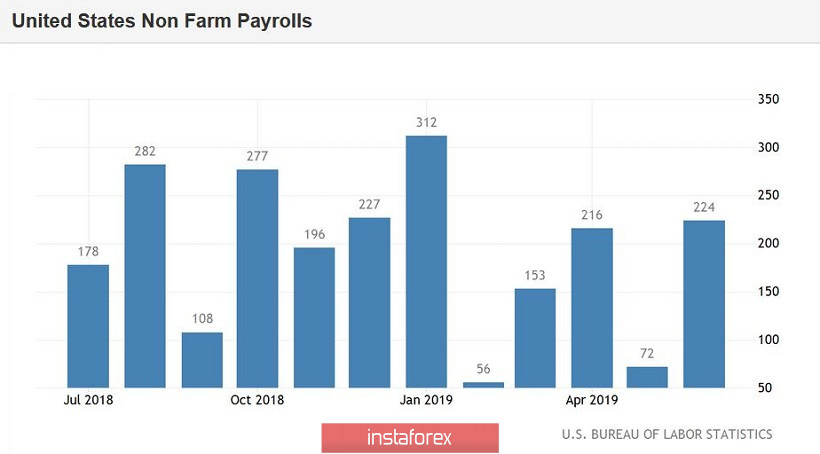

On Thursday, the economic calendar for the EUR/USD pair is almost empty. Only the ISM manufacturing index is of interest with a slight expected increase to 52 points. Yet on Friday, the key data on the growth of the labor market in the United States will be published. According to preliminary forecasts, Nonfarm will again support the American currency and the unemployment rate should remain at the minimum level of 3.7% with a sufficiently significant increase in the number of employees (+160 thousand). We should also note that the growth rate of the average hourly wage. Experts expect further growth of the indicator and it should reach 3.2% in annual terms. If the declared figures are confirmed, the dollar will receive significant support, continuing the rally throughout the market.

The EUR/USD pair maintains the potential for further decline, both in terms of the foundation and technical aspect. The target of the downward movement are the two price marks at 1.0950 (the lower limit of the Kumo cloud on the monthly chart) and 1.0850 (the lower line of the Bollinger Bands on the same timeframe). Despite all the relevant refutations of his advisors, the only obstacle to this could be Donald Trump. In my opinion, when the bears overcome the EUR/USD mark of 1.1000, the reaction of the American president will follow, especially if the Fed does not demonstrate a frank dovish attitude. If Trump still threatens the dollar with a currency intervention, the pair will return (at least) to the 12th figure, regardless of the success or failure of the macroeconomic releases.