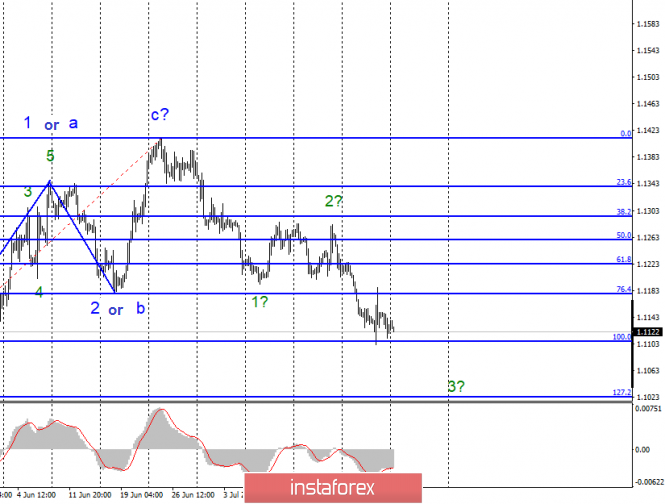

EUR / USD

On Friday, July 26, trading ended for EUR / USD with a loss of another 20 basis points. Thus, the prospective wave 3 continues its construction with targets located near the level of 127.2% Fibonacci. Since I expect 5 waves down, the Eurocurrency may still fall significantly over the coming weeks. The news background now supports such an option, as the ECB showed to the markets last week that monetary policy easing is required, as the economic indicators of the block continue to fall. This week, the Fed may come to the aid of the euro, but the Forex market has long been discussing the rate cut by the US regulator, so it's not worth waiting for a strong dollar decline. The only hope is that the mood of the Fed and Jerome Powell will be more "dovish" than what the markets are waiting for. There is an unsuccessful attempt to break level 100, 0% Fibonacci may also lead to a departure of quotes from the lows reached. These two factors are the hopes of the bulls this week, at least in the next three days. The activity of the Forex market today is unlikely to be high, as the news calendar does not contain anything interesting and thus, it causes attention.

Purchase goals:

1.1412 - 0.0% Fibonacci

Sales targets:

1.1106 - 100.0% Fibonacci

1.1025 - 127.2% Fibonacci

General conclusions and trading recommendations:

The euro-dollar pair has resumed the construction of the downward trend. Lowering sentiment in the Forex market remains. Thus, I recommend selling the pair with targets located near the levels of 1.1106 and 1.1025, which equates to 100.0% and 127.2% Fibonacci. An unsuccessful attempt to break through 11 figures will indicate a possible rollback.

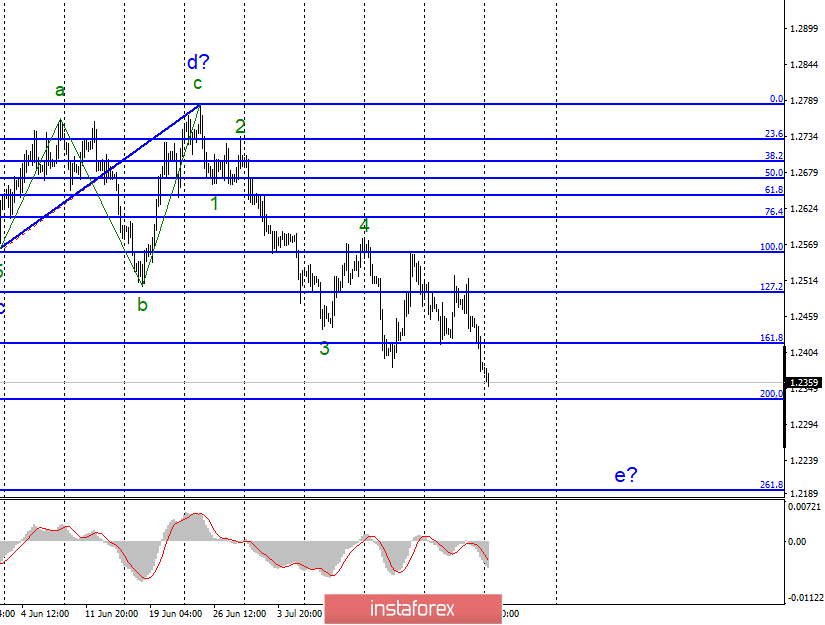

GBP / USD

The pair GBP / USD declined on July 26 by 70 basis points and broke through the previous local minimum, which a couple of days ago was interpreted as a minimum of wave e and the entire downward trend segment. Now, the wave e takes a more complex form, and the pound sterling receives new grounds for a new fall. News background remains the main reason for the widespread sales of English currency. The other day, Boris Johnson created a special committee that will be called upon to prepare the country to leave the EU without an agreement. A little earlier, Jean-Claude Juncker stated that he would not go to a meeting with Boris Johnson and would not conduct new negotiations on the terms of the agreement. Thus, the UK is left with nothing more than preparing to exit without an agreement. And the markets can only sell the pound and buy the dollar, since Brexit without a deal is a catastrophe for the UK.

Sales targets:

1.2334 - 200.0% Fibonacci

1.2194 - 261.8% Fibonacci

Purchase goals:

1.2783 - 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound-dollar tool now implies a complication of the downward trend. Thus, I again recommend selling the pair for each MACD down signal with targets located near the estimated levels of 1.2334 and 1.2194.