US GDP growth of 2.1% in the second quarter made it possible for the S&P 500 to rewrite record highs and somewhat dampened the enthusiasm of worshipers of the safe-haven. If the US economy is still strong and consumer spending has been expanding at the fastest rate since 2017, with global risk appetite, everything should be fine. Despite the longest economic expansion in the United States in history, unemployment at the lowest levels in half a century and strong macroeconomic statistics, the Fed is still going to reduce the rate for preventive purposes. True, the 25 bp market is hardly surprising.

For a long time, it was believed that it was hopes for a weakening of monetary policy that were pushing up the US stock market, but employment, retail sales, industrial production and GDP convinced that everything was in order with the US economy. Yes, it is losing speed from the abnormally high at almost +3% in 2018 to normal. Apparently, the central bank will do everything possible so that the expansion continues. Contrast with other developed countries maintains a strong demand for the US dollar. Moreover, the main economic adviser Larry Kudlow said that the US president had abandoned the idea of currency interventions. The market calmed down, but not for long. Until Donald Trump said that he could make that decision in two seconds.

The yen is heavily dependent on developments in the United States and in the global economy. The growth of the USD/JPY pair is directly related to the S&P 500 rally, the strengthening of the US dollar and the reduction in the likelihood of a federal funds rate cut by 50 basis points at the July FOMC meeting. In this regard, the Fed meeting and the release of data on the US labor market for July make it possible for the yen to claim the role of the most interesting currency of the week by August 2. Moreover, the BoJ will also issue its verdict on monetary policy.

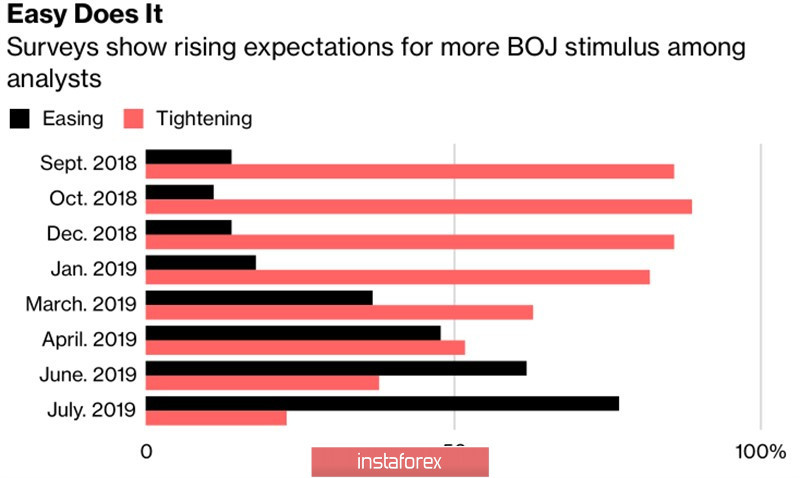

According to 77% of 47 Bloomberg analysts, the next step of the Bank of Japan will be monetary expansion, not tightening (in the June survey - 62%). 38 of them believe that there will be no monetary policy adjustments in July, 9 are counting on a signal to reduce the overnight rate in the future.

BoJ Monetary Policy Predictions

The market is actively discussing the topic regarding the Bank of Japan's limited opportunities. It already buys less assets than its policy provides, and negative rates harm the country's banking system. In this regard, the passivity of the regulator at the next meeting will be the first step towards restoring the "bearish" trend in USD/JPY. The second may be a modest reduction in the Fed rate on federal funds, the third - a weak statistics on the US labor market.

Technically, the return of quotations of the analyzed pair to the limits of the downward trading channel and the simultaneous breakthrough of support at 108.1 will indicate the return of the initiative into the hands of sellers. In contrast, a successful assault of resistance at 108.95 activates the reversal wedge pattern and will increase the risk of a pullback.