To open long positions on EURUSD, you need:

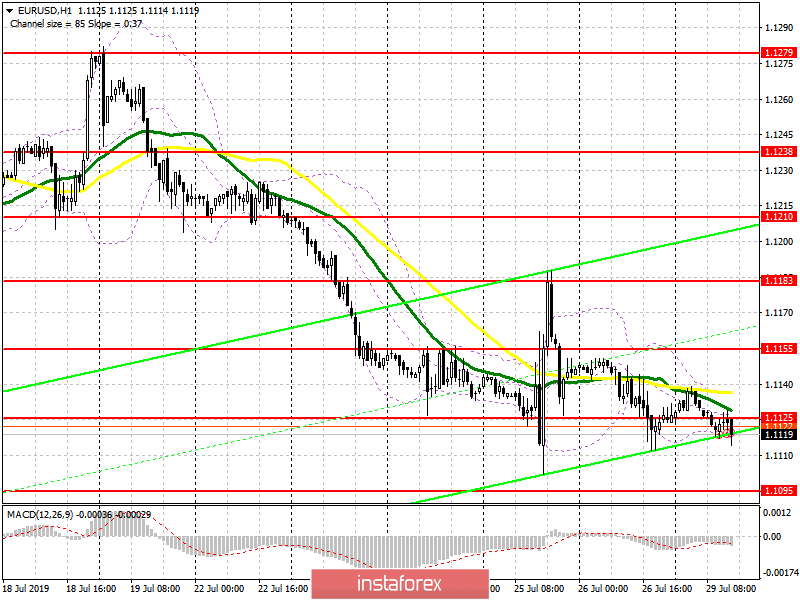

The European Central Bank's decisions last week surprised the markets, and now the move is for the US Federal Reserve. While there is uncertainty in the market, volatility will continue to remain low with a small advantage on the side of euro sellers. At the moment, trading is below the level of 1.1125, which is the middle of the channel, and buyers need to return to this range. This will allow us to expect an upward correction to the resistance area of 1.1155 and to update the upper boundary of the side channel of 1.1183, where I recommend taking the profit. However, the lack of important fundamental statistics today will continue to put pressure on the euro. In this scenario, it is best to look at the purchases on the test of a new monthly minimum in the area of 1.1095.

To open short positions on EURUSD, you need:

Bears shifted the market to the level of 1.1125 and formed resistance there. While trading is below this range, we can expect the continuation of the downward trend, which will lead to the exit of EUR/USD to new local lows in the area of 1.1095 and 1.1068, where I recommend taking the profit. In the scenario of returning buyers to the resistance level of 1.125 to short positions, it is best to return to a false breakout from the resistance of 1.1155 or sell from a larger maximum of 1.1183. In the second half of the day, no important reports are planned, so in the absence of constant pressure on the pair and its decline at the beginning of the North American session, the bears can retreat from the market, which will lead to a small upward correction and maintain low volatility until tomorrow.

Indicator signals:

Moving Averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market.

Bollinger Bands

Volatility is low, which does not give signals to enter the market.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20