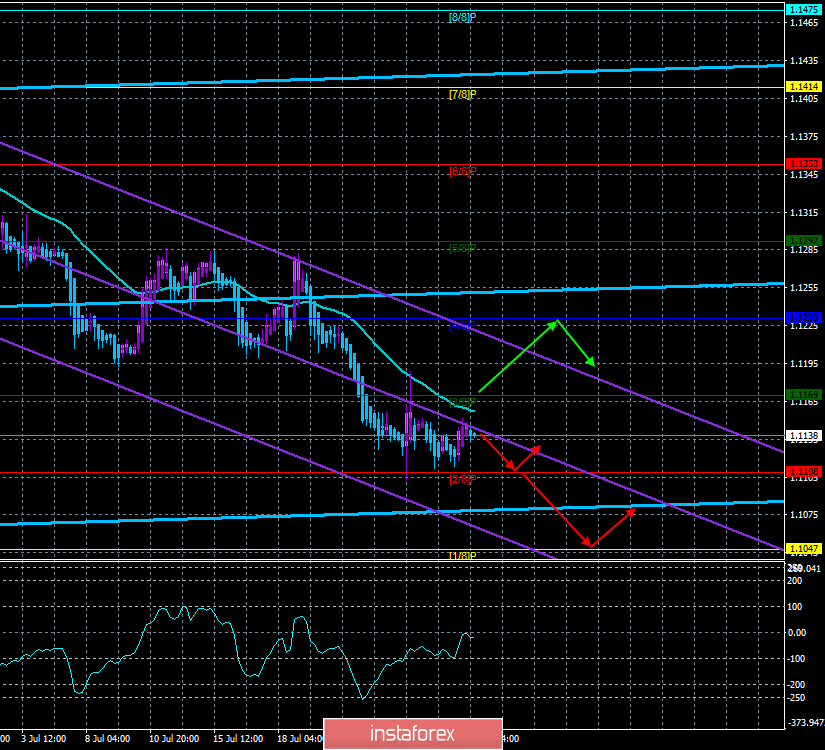

4-hour timeframe

Technical data:

The upper channel of linear regression: direction – up.

The lower channel of linear regression: direction – down.

The moving average (20; smoothed) – down.

CCI: -20.1304

The European currency is not nervous and calmly continues to trade around its two-year lows, waiting for new data. Indeed, why should traders force events, if the results of the Fed meeting will be known tomorrow. Also, important data on inflation and GDP in the eurozone will be released tomorrow. Thus, Monday did not surprise market participants. Today, July 30, the United States will issue relatively important reports on changes in the volume of income and expenditure of the population with forecasts of + 0.3% for each item in June, and the consumer confidence index later. This news is unlikely to change the current trend of the euro/dollar pair. Meanwhile, the US leader Donald Trump has already begun the traditional pressure on Jerome Powell and the Fed before the meeting. Probably, Trump believes that the next portion of criticism of Powell, he will be able to influence the decisions taken by the monetary committee. Powell bravely opposes these attacks. Trump's displeasure concerns the fact that, in his opinion, the ECB and the Bank of China are actively reducing the rates of their monetary units to have an advantage in the confrontation with America, while the Fed is inactive. However, traders are no longer interested in the next attack of the odious president. They are waiting for the official results and, unfortunately, for Trump, if the rate is reduced by 0.25%, it is unlikely that the US dollar will feel the effect of this easing.

Nearest support levels:

S1 – 1.1108

S2 – 1.1047

S3 – 1.0986

Nearest resistance levels:

R1 – 1.1169

R2 – 1.1230

R3 – 1.1292

Trading recommendations:

The EUR/USD currency pair started the upward correction. On July 30, therefore, it is recommended to wait for the reversal of the Heiken Ashi indicator down and sell the euro/dollar pair with the targets at 1.1108 and 1.1047.

It is recommended to buy the euro/dollar in small lots if the bulls manage to gain a foothold above the moving average line, with the first target Murray level of "4/8" - 1.1230.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator window.

The moving average (20; smoothed) is the blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.