Fears about a possible decision by the Fed to lower the rate at the July 31 meeting not by 0.25% but immediately by 0.50%. This covered the markets after several members of the FOMC spoke in favor of preventive actions on July 18, even before the main macroeconomic indicators began to signal about the onset of a recession gradually disappear. On Tuesday morning, as reported by Bloomberg, two-thirds of the surveyed experts tend to lower the rate by 0.25%.

Indeed, recent macroeconomic data give a reason for cautious optimism. Weekly applications for unemployment are better than expected. Growth in orders for durable goods in June was 2.0% with a forecast of 0.7%. The preliminary data on GDP growth in the 2nd quarter indicate a smaller than expected growth slowdown to 2.1% instead of 1.8%.

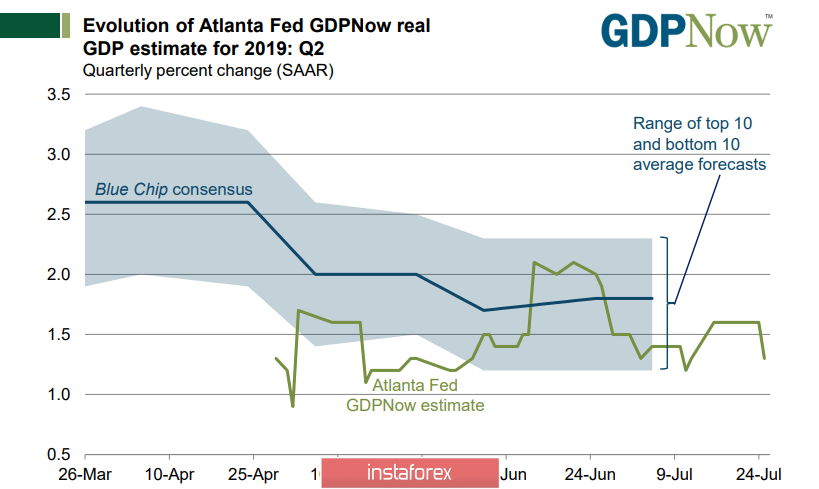

However, the current model from the Atlanta Federal Reserve Bank still insists on weak GDP growth of only 1.3%, which is rather strange against the background of decent figures from the Department of Commerce.

While the recession remains on the horizon (but there is still time), the main threat at the current stage is the possibility of a rise in the dollar rate. Following the decision of the FOMC, the problem is that all major central banks, without exception, will look for ways to prevent the growth of their national currencies against the backdrop of intensifying trade wars. Therefore, the FOMC's not enough dovish position can play a trick on the dollar.

As a result, the Fed needs to play a very subtle scenario. On the one hand, it does not allow the dollar to strengthen and on the other, it does not show that the Fed is worried about the approaching recession. At the same time, it not to provoke panic sales. In this scenario, a 0.50% rate reduction is not advisable since it is guaranteed to cause panic. Therefore, one should expect a reduction in the rate of 0.25% and give guidance on further actions. The meeting will not be accompanied by the publication of updated macroeconomic forecasts therefore, the markets will not see the specific target for the rate, which gives Fed Chairman Powell some room to maneuver.

Thus, the key to the markets will be whether the language regarding the Fed's future policy remains unchanged or is adjusted. It is the likelihood of a correction in the position of the Fed in one direction or another, which will determine the trend of both the dollar and the state of world markets in the medium term.

Markets expectedly restructured before the FOMC meeting. Oil prices are rising in anticipation of a rate cut and the start of the next round of negotiations between the US and China also contributes to growth. Concurrently, gold also rises in price, which indicates a small margin of expectations in favor of a dollar decline after the meeting.

USD/CAD pair

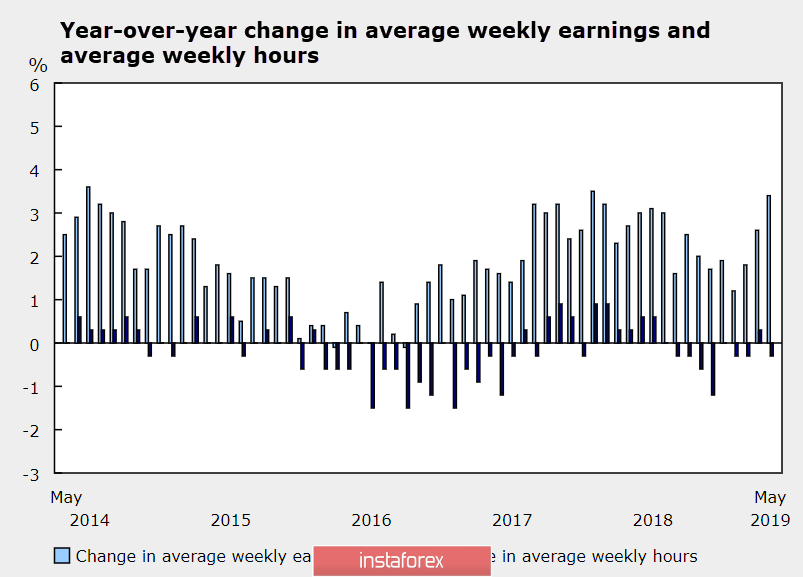

The short-term impulse is not in favor of Loonie, despite the support of a number of factors such as rising oil prices, stabilizing investment in construction and industry growth, and the average weekly earnings exceeded 3.4% in May (which is in favor of inflation).

At the same time, a short-term impulse on the USD/CAD pair is in favor of growth. The loonie has no chance before the announcement of the results of the FOMC meeting. Support levels are 1.3160 and 1.3130 with the immediate goal of 1.3198, then to 1.3215. Further dynamics will depend entirely on the results of the FOMC meeting.

USD/JPY pair

The Bank of Japan kept the interest rate at the level of -0.1% and the decision coincided with market expectations. The policy of targeting the yields of 10-year government bonds at the near-zero level and expanding the monetary base by 80 trillion yen per year has also been confirmed. Moreover, the repurchase volumes of securities have been preserved.

BoJ's decision fully complied with market expectations and the accompanying commentary also repeats all the theses that the bank voiced earlier. The yen did not respond to the outcome of the meeting, which prefers to move in the wake of market expectations as decided by the Fed.

The dollar looks stronger and the support is at 108.50 / 60, then to 108.30 / 40 with the closest target of 108.99, then to 109.48. The high probability of USD/JPY growth will continue until the end of the week.