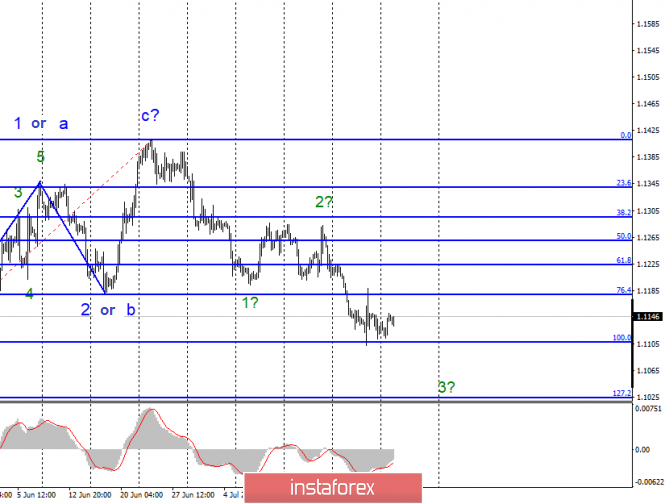

EUR / USD

On Monday, July 29, trading ended with 15 basic points for EUR / USD. However, such a small increase does not affect the current wave marking. Eurocurrency needs a basis for building a new upward trend. The news background, however, remains not in favor of the euro, and the current wave counting supports a further increase in the US currency. At the moment, the euro-dollar keeps from the new fall only at the level of 100.0% Fibonacci. An attempt to overcome it was unsuccessful. The nearest interesting event that may affect the course of trading will be the Fed meeting, which begins today, and tomorrow its results will be known. The Forex market is confident that monetary policy will stood by 0.25%. If these assumptions are confirmed, then it is not worth waiting for a strong dollar fall since this rate cut is already laid in the current dollar rate. And there are no other options for the Fed. Thus, once again, much will depend on the speech of Jerome Powell at the press conference. If he gives a signal to the market that rates will decline in the future, this is exactly what can stop the growth of the dollar.

Purchase goals:

1.1412 - 0.0% Fibonacci

Sales targets:

1.1106 - 100.0% Fibonacci

1.1025 - 127.2% Fibonacci

General conclusions and trading recommendations:

The euro-dollar pair continues to build the downward trend. Lowering sentiment in the Forex market remains. Thus, I recommend selling the pair with targets near the levels of 1.1106 and 1.1025, which equates to 100.0% and 127.2% Fibonacci for the new MACD signal down.

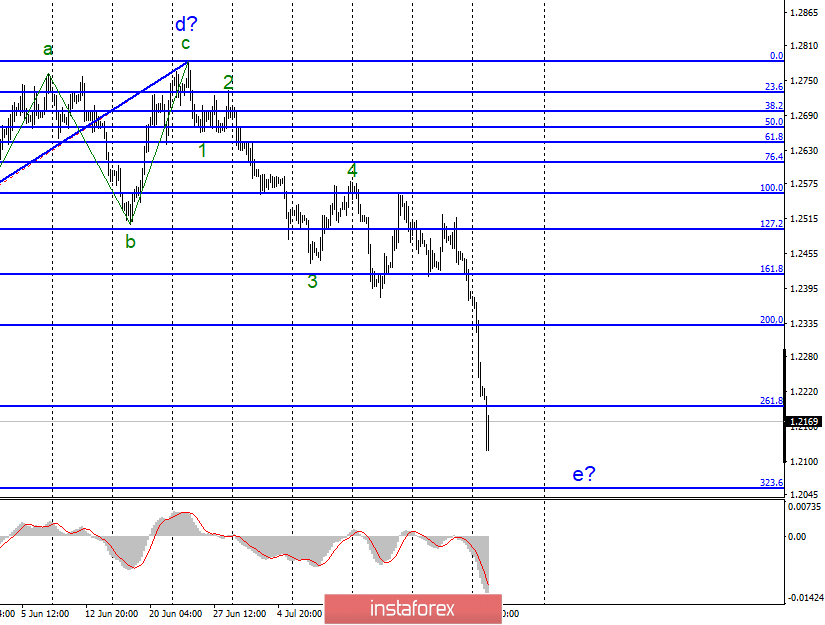

GBP / USD

The GBP / USD pair declined on July 29 by 170 basis points and continues to build the downward trend and its expected fifth wave, which takes a complex and extended form. If it were not for the news background, which is no longer just in favor of the dollar, but is thorough in favor of the dollar, then the market could count on building at least a three-wave correction segment of the trend. But since under Boris Johnson, Brexit's likelihood has increased several times without a deal, the markets continue to get rid of the pound sterling. This fall can only be stopped by the Fed in the near future, if it unexpectedly reduces the rate by 0.5%, or Boris Johnson himself, who suddenly finds a common language with EU leaders regarding Brexit conditions. As we understand, the probability of both events is extremely low, so it is more likely that the corrective growth of the pound-dollar pair will begin while maintaining the downward trend.

Sales targets:

1.2194 - 261.8% Fibonacci

1.2056 - 323.6% Fibonacci

Purchase goals:

1.2783 - 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound-dollar tool now implies a complication of the downward trend. Thus, I recommend selling the pair for each MACD down signal with targets located near the estimated levels of 1.2194 and 1.2056.