During the Monday auction on July 29, the cost of Brent crude oil showed a positive trend against the background of a possible reduction in the Fed rates. The uptrend continued on Tuesday. In many ways, he was helped by statements by the American president, Donald Trump, about the insufficiency of a small cut in the Fed's rates.

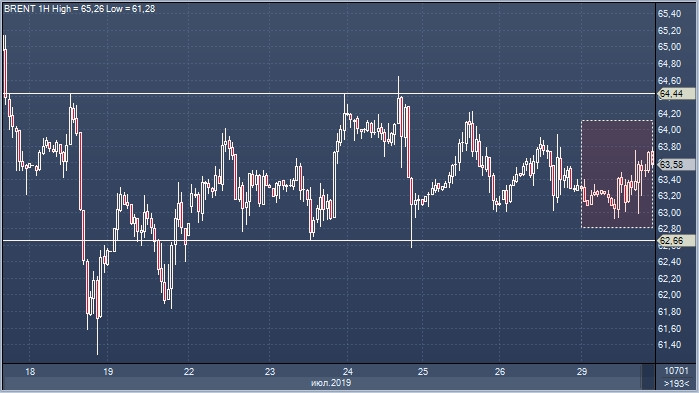

According to the observations of experts, Brent crude quotations opened the trading week on a positive note, recovering to $64 a barrel. Currently, black gold is trading in the range of $ 64.17 to $ 64.25 per barrel. According to analysts' calculations, only a confident fixation of quotations above $65 per barrel will help break the downward trend and Brent is balancing near to it. The oil prices were supported by rising tensions in the Middle East, which returned to the previous concerns of the market about a disruption in the supply of raw materials.

In addition to events in the Middle East, statistics on US oil reserves from the American Petroleum Institute (API) is capable of having a positive impact on Brent quotes. On Tuesday, the agency will present its assessment of the weekly change in stocks of raw materials. In case of their decrease, Brent will get an excellent opportunity to rise to $65 per barrel. According to a leading strategist at RJO, Phillip Streible, the global demand for black gold remains low. In order for oil quotes to be above current levels, China needs to increase purchases and the demand in the US should increase even more, analyst said.