When traders have doubts, they begin to close positions. The main "bearish" driver in the oil market is considered to be the reduction in global demand under the influence of trade wars and a slowdown in the global economy. Nevertheless, the fastest growth in consumer spending since 2017 in the United States in the second quarter, as well as six consecutive weeks of a decline in US black gold reserves, indicate that demand in the leading country of the world is all right. And then there is the Fed with its intention to stimulate an already non-weak economy by lowering the federal funds rate. Have the bears overdone selling Brent and WTI?

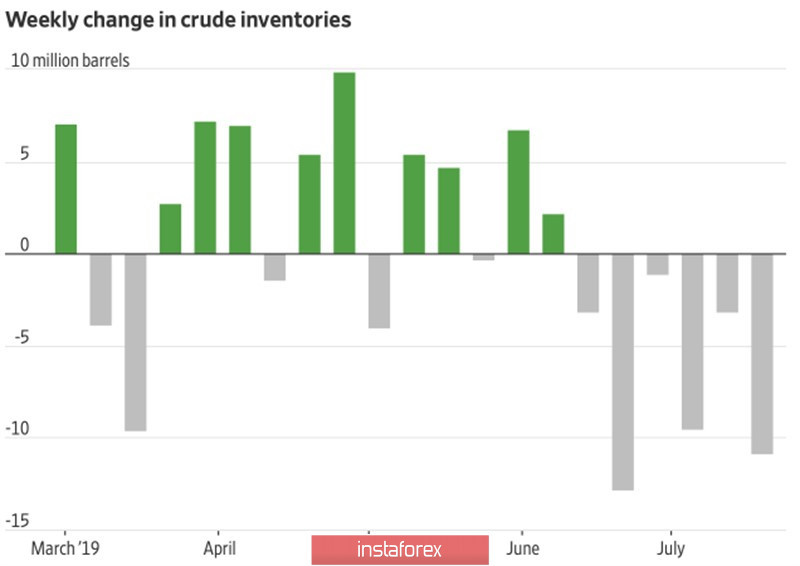

The influential London-based broker PVM said that at present there is such a situation on the market that oil can easily both grow by $30 and fall by $30 per barrel. Everything will depend on which driver the market will choose. If the conflict between the West and Iran, which is fraught with the overlap of the Strait of Hormuz, the most important waterway for suppliers of black gold, then Victoria is celebrated by the bulls. If the reduction in global demand - bears. In this regard, any deviation from one of the two above scenarios becomes a pretext for closing positions. In the week to July 19, US stocks dropped by more than 10 million barrels to its lowest level since March. Supply is clearly not keeping up with the demand. Good news for fans of black gold.

Dynamics of US oil reserves

The North Sea variety has been growing for the third consecutive trading session due to strong statistics on the United States, the resumption of trade negotiations between Washington and Beijing, and hopes for the first federal fund rate cut since 2008. At the same time, Donald Trump continues to criticize the US Federal Reserve. So far, it has acted incorrectly, allowing competitors to stimulate their own economies with the help of devaluation. Even reducing the cost of borrowing by 25 bp will not be enough, but America will still win! The derivatives market estimates the likelihood of aggressive monetary expansion in July at 26-27%, which is not so little. The Fed can really reduce the rate by 50 bp, and then take a long pause. In this scenario, the assets of the commodity market will receive a new reason for optimism.

On the contrary, a modest easing of monetary policy has already been taken into account in the quotations of financial instruments, therefore only Jerome Powell is able to prevent the collapse of stock indices. For this, dovish rhetoric and an open door to further monetary expansion are necessary. From oil, I also expect a violent reaction to the announcement of the outcome of the July meeting of the FOMC. Firstly, they will affect the US dollar (Brent and WTI are listed in this currency), and secondly, they will allow us to predict the improvement or deterioration of the US oil demand.

Technically, bears of the North Sea variety could not bring quotes outside the triangle, which is the first sign of their weakness. In order to continue the rally, bulls need to gain a foothold above $64.1 per barrel, and then take the resistance at $65.9 and $67.5 by storm.