For one and a half weeks from July 19, the Australian currency together with the dollar showed an almost not pullback decline, dropping from 0.7080 to a local minimum of 0.6864. The revaluation of the greenback, as well as the "dovish" position of the head of the RBA, had significant pressure on the pair, especially against the background of ambiguous prospects for the next negotiation process between China and the United States. ut today, the Australian has received a reason for corrective growth throughout the market. Published data on inflation in Australia were better than expected, reducing the likelihood of further reductions in the RBA interest rate. Here, it is worth recalling that in the course of his last speech, the head of the regulator, Philip Lowe, did not announce a rate cut in the autumn. He only allowed such a probability.

Lowe made it clear that members of the regulators are ready to lower the rate one more time this year but only if the measures were taken earlier (not only from the RBA but also from the government) do not bring the desired result. Today's inflation figures may indicate that the Australian economy is not so urgently in need of further easing of monetary policy parameters. Also, if the other key indicators will also show growth in the second half of this year, the Reserve Bank will most likely take a wait-and-see position, putting the mitigation process on a long-term pause.

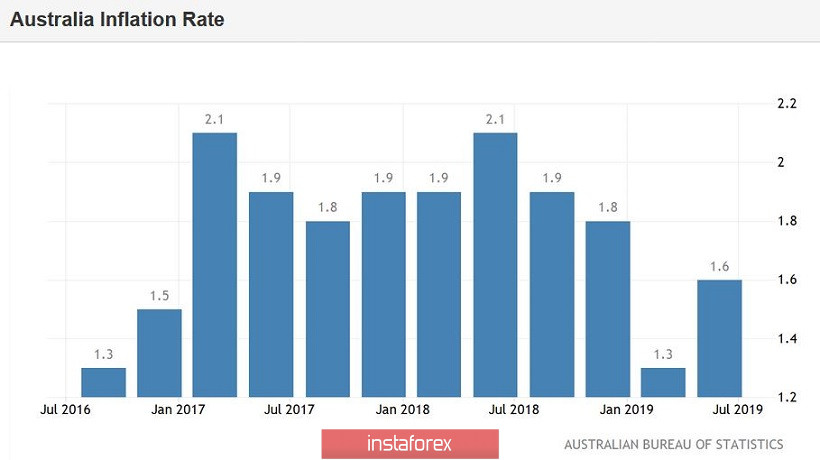

However, back to the numbers. According to published data, the consumer price index in the second quarter rose to 1.6% (with a forecast of 1.5%) in annual terms and to 0.6% on a quarterly basis (with a forecast of 0.5% and the previous value of 0%). although the published figures turned out to be slightly better than expected, the trend itself is important here. In particular, the figure rose for the first time in annual terms after a three-quarter decline.

I note that the Australian government at the beginning of this year initiated the introduction of tax incentives for millions of households (for people with low and middle income), in the hope of stimulating consumer spending growth. In addition, a double decline in the interest rate of the RBA this year resulted in the banking sector lowering mortgage rates, which in turn helped the recovery of the extremely weak housing market in Australia. Also, we should not forget about the significant growth of the commodity market, which had a positive impact on the national economy. All these factors have contributed to the growth of consumer activity and business confidence in the country by supporting inflationary processes.

Some support for the Australian was provided by Chinese data despite its contradictory nature. Today, we learned the data of the PMI index for the production sector. This indicator has slightly grown up to 49.7 points. On the one hand, the indicator was better than expected but on the other hand, the indicator still shows extremely weak dynamics. I recall that the values below the 50th mark indicate a slowdown in the relevant sector of the economy.

In general, the recently announced position of the RBA has increased the role of key macroeconomic indicators. At the same time, the probability of an autumn decline to 0.75% (in October or November) until recently was almost 100%. Today's release could not drastically change the situation, but still the Australian sharply reacted to inflationary growth in the country. The AUD/USD pair came close to the 69th figure but it's too early to talk about a trend reversal. Now, we are seeing only corrective growth. To confirm the upward movement of the pair bulls, it is necessary not only to overcome the 70th mark but also to gain a foothold above it. The Australian dollar is not yet capable of "independently" pulling a pair to this target. Despite rising inflation, the likelihood of a third rate cut this year is still high. The market has to make sure that that the Australian economy is recovering "on all fronts" - including in the labor market. Only after that traders will reconsider their attitude towards the prospects of the monetary policy of the RBA. Therefore, further growth of the AUD/USD pair depends only on the behavior of the dollar, which is in anticipation of the Fed's verdict.

From a technical point of view, the AUD/USD pair s traded between the middle and lower lines of the Bollinger Bands indicator on the daily chart, under all the lines of the Ichimoku Kinko Hyo indicator, which formed a bearish signal "Parade of lines". All of these suggest that the pair retains the potential to reduce to the bottom line of the above indicator, that is, to the level of the local price minimum of 0.6864. The situation will change only if buyers overcome the lower boundary of the Kumo cloud (0,6930). In this case, they will have a way to the upper boundary of the cloud, which corresponds to the mark of 0.7005. Only entrenched over this target, the bulls "cancel" the priority of the downward trend. But, as mentioned above, such dynamics is possible only due to the weakness of the American currency.