EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair performed a reversal in favor of the euro currency and started the growth process in the direction of the correction level of 76.4% (1.1180). There are no emerging divergences today for the euro/dollar pair. The euro is growing ahead of the Fed meeting, where the key rate is likely to be reduced by 0.25%. This has been written many times, and the foreign exchange market has long taken into account this decline in the current rate. So the more important question now is Jerome Powell's rhetoric at the evening press conference. Recent macroeconomic indicators have shown an improvement, so I wonder if Powell will signal the need to further reduce the rate? Will he note again the growing threats to the world economy, the risks of the US economic recession, weak inflation, the threat of trade wars and so on? If you follow the new eurozone in 2019 or even a few drops, it could convince traders that the greenback won't need to buy in any case. Yesterday's news from America showed an increase of 0.3% in the level of spending and 0.4% in the level of income of citizens. This is no more and no less than the forecasts of experts and market expectations. The rebound of quotations from the Fibo level of 76.4% will allow traders to expect a reversal in favor of the US currency and a resumption of the fall in the direction of the correction level of 100.0% (1.1107).

The Fibo grid is built on the extremes of May 23, 2019, and June 25, 2019.

Forecast for EUR/USD and trading recommendations:

The EUR/USD pair has begun to grow in the direction of the correction level of 76.4% (1.1180). I recommend selling the pair today with the target of 1.1107, with the stop-loss order above the level of 1.1180 if it will be rebounded from the level of 76.4%. I recommend buying the pair with the target of 1.1224 and stop-loss order under the level of 1.1180, if closing above the correction level of 76.4% is performed.

GBP/USD – 4H.

The pair GBP / USD has consolidated below the correctional level of 127.2% (1.2180). Why the pound falls can probably be explained now by any child. Hard Brexit is not just a threat to the welfare of the UK and its citizens. This is a complete rupture of relations with the European Union. And there are many ties between Britain and the Alliance. For example, London will lose all trade agreements with countries outside the EU, European laws will cease to operate in the UK. Some large companies have already left Britain because of the very vague future of the country. Potentially, it also means the introduction of duties on trade with the EU, reducing investment in the economy, the outflow of citizens, rising inflation, unemployment, budget deficit, and GDP reduction. And the consequences of Brexit without agreements will be visible for a long period of time. This is what the Chairman of the Bank of England Mark Carney has repeatedly warned about, and this is what the British Parliament had in mind when it refused to approve such a scenario under the government of Theresa May. However, there are no alternatives to tough Brexit. Thus, the best option would be to simply respond to news from the UK. If there are grounds to expect the resumption of negotiations with the European Union, it can have a beneficial effect on the pound. Hard Brexit will lead to an even greater collapse of the quotes of this currency.

The Fibo grid is built on the extremes of January 3, 2019, and March 13, 2019.

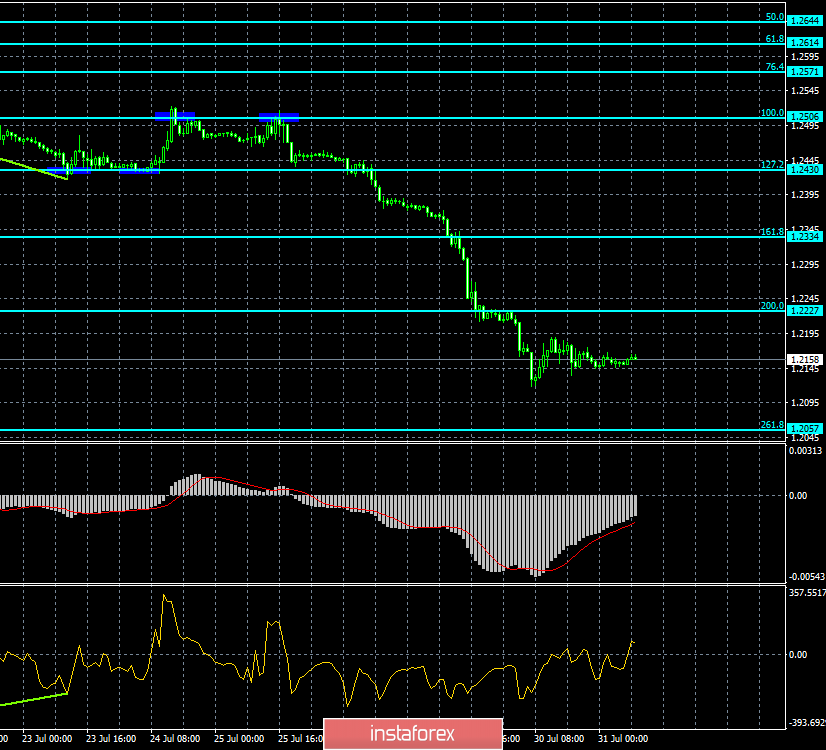

GBP/USD – 1H.

As seen on the hourly chart, the pound/dollar pair stopped falling in the direction of the correction level of 261.8% (1.2057). Today, the divergence is not observed in any indicator. The rebound of quotations from the Fibo level of 261.8% will allow counting on a reversal in favor of the English currency and some growth in the direction of the correction level of 200.0% (1.2227).

The Fibo grid is based on the extremes of June 18, 2019, and June 25, 2019.

Forecast for GBP/USD and trading recommendations:

The GBP/USD pair continues the process of falling. Thus, I recommend selling the pair with a target of 1.2057, with the stop-loss order above the level of 1.2227. I recommend buying the pair with the target of 1.2227 and stop-loss order under the level of 261.8% (hourly chart) if it will be rebounded from the level of 1.2057.