To open long positions on EURUSD, you need:

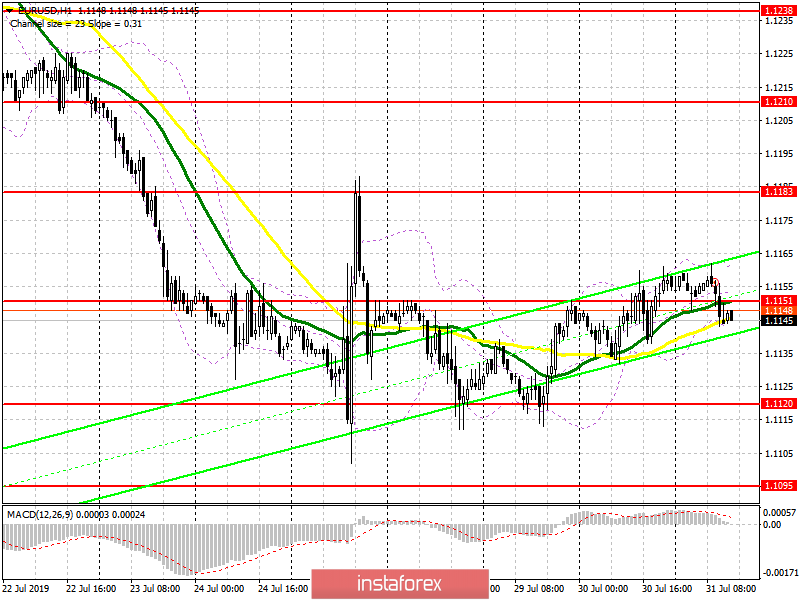

A number of reports on inflation, GDP growth and unemployment in the eurozone were ignored by the market. First, all the data almost coincided with the forecasts of economists, and secondly, all the emphasis is on the publication of the Fed's decision on the interest rate, which is a more important event. Buyers failed to hold the support level of 1.1151, which I paid attention to in my morning review, which plunged the market into even more despondency. At the moment, the task of the bulls will be to return and consolidate above 1.1151, but everything will depend on the Fed's decision and comments that will follow. Growth above 1.1151 may lead to an update of the maximum of 1.1183, the breakdown of which will form a new upward wave to the area and will lead to a test of the levels of 1.1210 and 1.1238, where I recommend taking the profit. If the pressure on EUR/USD continues after the Fed statements, it is best to return to long positions after the test of the minimum of 1.1120 or to rebound from the level of 1.1095.

To open short positions on EURUSD, you need:

Bears coped with the morning task and returned to the level of 1.1151. However, as we can see on the graph, it did not lead to anything. Trade remains and will remain until the Fed's decision in the side channel, with very low volatility. EUR/USD decline in the area of the minimum of 1.1120, as well as its breakdown, will be a clear signal for a return to the market of sellers, which will lead to an update of the lows in the area of 1.1095 and 1.1068, where I recommend taking the profit. If the demand for the euro returns after the Fed's statements, it is best to return to short positions on a false breakout from the resistance of 1.1183 or on a rebound from a larger maximum of 1.1210.

Indicator signals:

Moving Averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market.

Bollinger Bands

Volatility is low, which does not give signals to enter the market.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20