The data on the eurozone economy, released today in the first half of the day before the publication of an important Federal Reserve System interest rate decision, was ignored by the market, but indicated the need to ease monetary policy, which is likely to maintain pressure on the euro and further in the medium term, even with lower interest rates in the United States.

I spoke in more detail about the prospects of the US dollar in this morning's review.

Annual inflation in France fell sharply. Even despite the preliminary data, it is already possible to note deflation in July this year compared to June. According to the report, the preliminary consumer price index (CPI) in France in July of this year decreased by 0.2% compared to June and increased by only 1.1% compared to the same period in 2018. Economists had expected an even larger decrease of 0.3% compared with June and an increase of 1.2% per annum. As for the consumer price index harmonized by EU standards in France, it rose by 1.3% in July compared to July 2018, against 1.4% in June.

In Italy, the preliminary consumer price index (CPI) in July rose only 0.1% compared to June and only 0.5% per annum, which almost coincided with the forecasts of economists.

As for the overall indicator for the eurozone, the data also coincided with the forecasts of economists, which, of course, did not please the leadership of the European Central Bank, whose goal is the level of about 2.0%.

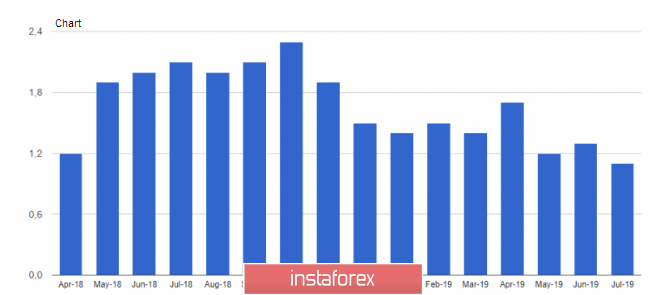

According to the preliminary report, the consumer price index (CPI) of the eurozone in July rose 1.1% per annum against 1.3% per annum in June, which coincided with the expectations of economists. Core inflation, which does not take into account the volatile categories, showed an increase of only 0.9% per annum.

Today, a report on the unemployment rate in Germany and the eurozone was also released.

According to the data, the number of unemployed in Germany increased in July, which added problems to the European regulator, as the weakness of the labor market will necessarily result in a slowdown in economic growth.

According to the data, the number of applications for unemployment benefits in Germany in July this year increased by 1,000, while economists had expected that in July the number of unemployed increased by 2,500. The bureau of statistics noted that the growth occurred mainly as a result of the summer holidays, but the demand of companies for new employees also slightly weakened. The overall unemployment rate in July was 5%, and the number of registered vacancies in July fell to 799,000, which is 24,000 less than a year earlier.

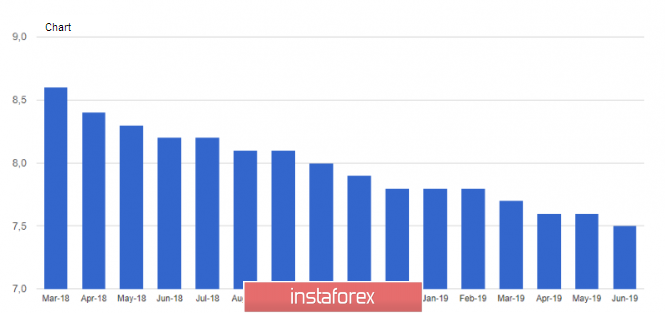

The unemployment rate in the eurozone in June fell to 7.5%, against 7.6% in May this year, but this is not enough for inflation to start to gradually return to the level of 2.0%. The data also fully coincided with the forecasts of economists, which did not lead to any market changes.

Weak growth of the eurozone economy, even if the data were preliminary, also indicates that it is time for the European Central Bank to take action and return to economic stimulus programs until growth has stopped at all.

According to today's report, eurozone GDP in the 2nd quarter of this year showed a weak growth of 0.2% compared to the 1st quarter, and grew by only 1.1% compared to the 2nd quarter of 2018. The data completely coincided with the forecasts of economists.

As for the current technical picture of the EURUSD pair, serious changes in the market will occur only in the late afternoon, when the Federal Reserve will announce its decision on interest rates.

While trading is around the level of 1.1150, from which the main movement will be formed. It will be possible to talk about the change in the current short-term trend only after breaking through the level of 1.1185, which was formed last week, above which the maximums open around 1.240 and 1.1310. In the case of a return of pressure on the European currency, support will be provided by a weekly minimum in the area of 1.115 or a larger area of 1.1090.