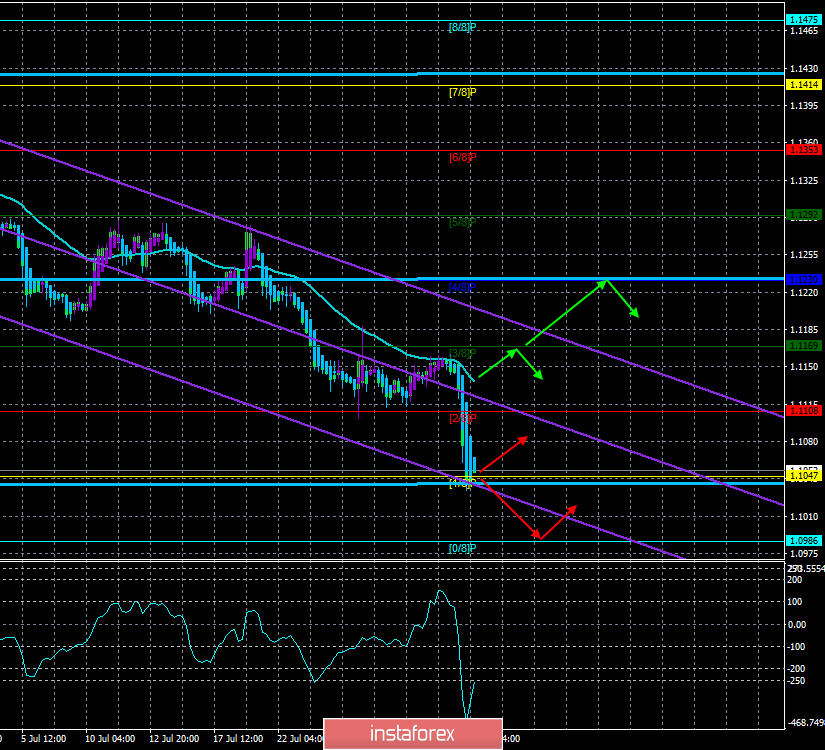

4-hour timeframe

Technical data:

The upper linear regression channel: direction – sideways.

The lower linear regression channel: direction – down.

The moving average (20; smoothed) – down.

CCI: -258.0041

Yesterday morning, we wrote that the performance of Jerome Powell will be more important than the Fed's decision on rates, which traders have long taken into account in the quotes of the EUR/USD pair. Powell's speech was short and he told the foreign exchange market that there was no question of a long course of lowering rates. That is, the current easing of monetary policy by 0.25% – on the one hand, a forced measure because of the growing global risks, the trade war with China, as well as insufficient inflation, and on the other – a preventive and stimulating measure. However, the Fed is not going to use this method on a regular basis in 2019. Another rate cut this year is possible, but it will depend on the fundamental factors that the Fed fears. In the case of improvement of macroeconomic indicators, de-escalation of the trade conflict with China, reduction of geopolitical tension and global risks, there will be no reason for another reduction of the key rate. In general, Powell made it clear that he was not talking about Donald Trump, who immediately commented on his decision on the Fed's decision to lower the rate, which led to a further increase in the dollar. He said that Powell disappointed him again, but at least completed the period of tightening monetary policy, which did not need to start. Also, Trump complained that the support from the Fed "he apparently did not get." Well, the euro/dollar pair reacted with a drop of 1 cent on the last day of July.

Nearest support levels:

S1 – 1.1047

S2 – 1.0986

S3 – 1.0925

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1169

R3 – 1.1230

Trading recommendations:

The EUR/USD currency pair resumed its downward trend after the performance of Jerome Powell. On August 1, therefore, it is recommended to continue selling the euro/dollar pair with the targets of 1.1047 and 1.0986, until the reversal of the Heiken Ashi indicator to the top.

It is recommended to buy the euro/dollar in small lots when the bulls manage to gain a foothold above the moving average line, with the first target Murray level of "4/8" - 1.1230.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator window.

The moving average (20; smoothed) is the blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.