4-hour timeframe

Technical data:

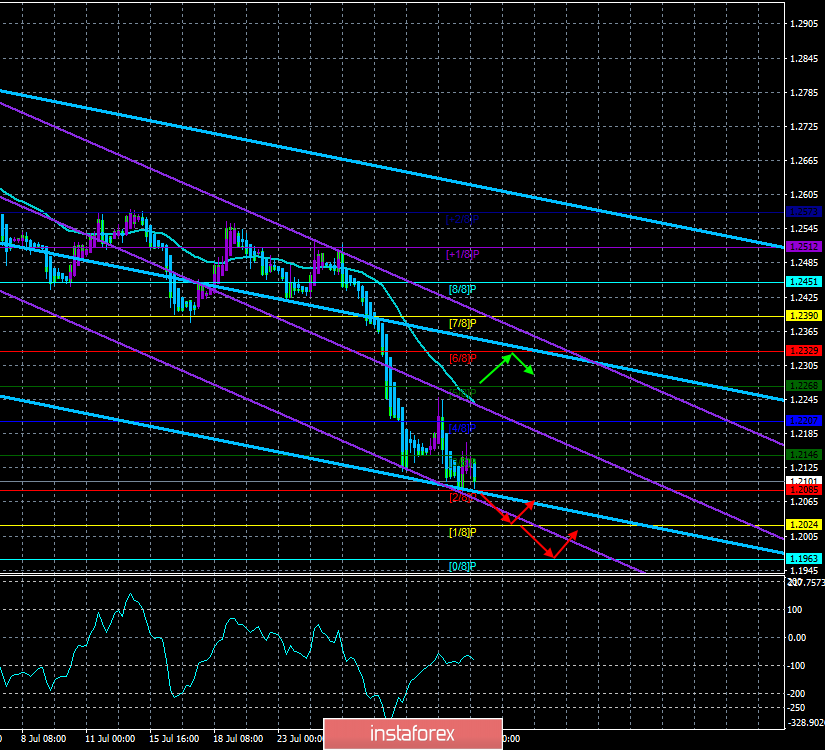

The upper linear regression channel: direction – down.

The lower linear regression channel: direction – down.

The moving average (20; smoothed) – down.

CCI: -80.8392

The British pound sterling was minimally corrected tonight but already shows signs of readiness for the resumption of the downward trend. Today, as in the case of the euro, much for the pair will depend on macroeconomic statistics from the States. In addition to it, the UK will release an index of business activity in the construction sector, which is located in the "red zone" and is unlikely to get out of it in the near future. Thus, the pound's hopes are again connected with America. If the news that comes from there are unfavorable, the bears can fix part of the profit on short positions, which will lead to a strengthening of the British currency. There are no new messages from Boris Johnson, except that in his office, he set the countdown timer to Brexit. Now, everyone can clearly see how much time is left before the country leaves the EU. Meanwhile, an interesting study was conducted, which shows the approximate distribution of votes in the parliamentary elections. If Johnson starts the election right now (before Brexit), Labor and Conservatives will gain about the same number of votes, which is unlikely to help Johnson to get the approval of "hard" Brexit from Parliament, given the fact that Jeremy Corbyn with his team opposed such an option. If the parliamentary elections are held after a successful attempt of "hard" Brexit, Johnson's party will receive much greater support. However, the question remains: how is Johnson going to get approval from the current Brexit Parliament without a deal?

Nearest support levels:

S1 – 1.2085

S2 – 1.2024

S3 – 1.1963

Nearest resistance levels:

R1 – 1.2146

R2 – 1.2207

R3 – 1.2268

Trading recommendations:

The GBP/USD pair is trying to resume the downward movement, so now it is still recommended to sell the pound sterling with the targets of 1.2085 and 1.2024. The initiative in the market continues to remain in the hands of bears.

It will be possible to buy the pound/dollar pair with the goals of 1.2329 and 1.2390 not earlier than the price consolidation above the moving average line. However, this development is not expected in the coming days.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator regression window.

The moving average (20; smoothed) is the blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.