EUR / USD

On Thursday, August 1, trading ended with an increase of 10 basis points for the EUR / USD pair, although during the day the pair went much lower to the level of 127.2% Fibonacci, but then it recovered. The temporary weakening of the dollar is due, firstly, not to the most favorable index of business activity in the US manufacturing sector ISM (this index is the most important), and secondly, to the escalation of the trade conflict between the United States and China. Now the euro-dollar pair has its own "Indian series", which can drag on for many years, just like Brexit for the pound-dollar pair. The situation between Beijing and Washington is about the same as between Brussels and London. Washington provokes a conflict and demands that a trade agreement be signed on terms beneficial to it in the first place. China does not accept concessions and is subject to trade duties, which strongly beat on its economy, as the total amount of exports to America is more than 500 billion dollars a year. So Donald Trump just plays what he already holds in his arms. Indeed, why not bargain for the best conditions for yourself, if there is such an opportunity. Beijing, realizing who it is dealing with, is eager for a change of power in America and is unlikely to rush to negotiations or concessions to Donald Trump.

Purchase goals:

1.1412 - 0.0% Fibonacci

Sales targets:

1.1025 - 127.2% Fibonacci

1.0920 - 161.8% Fibonacci

General conclusions and trading recommendations:

The euro-dollar pair continues to build a downward trend. Downward mood in the Forex market remains. Thus, I recommend selling the pair with targets near the 1.1025 and 1.0920 marks, which equates to 127.2% and 161.8% Fibonacci when the MACD signal is down.

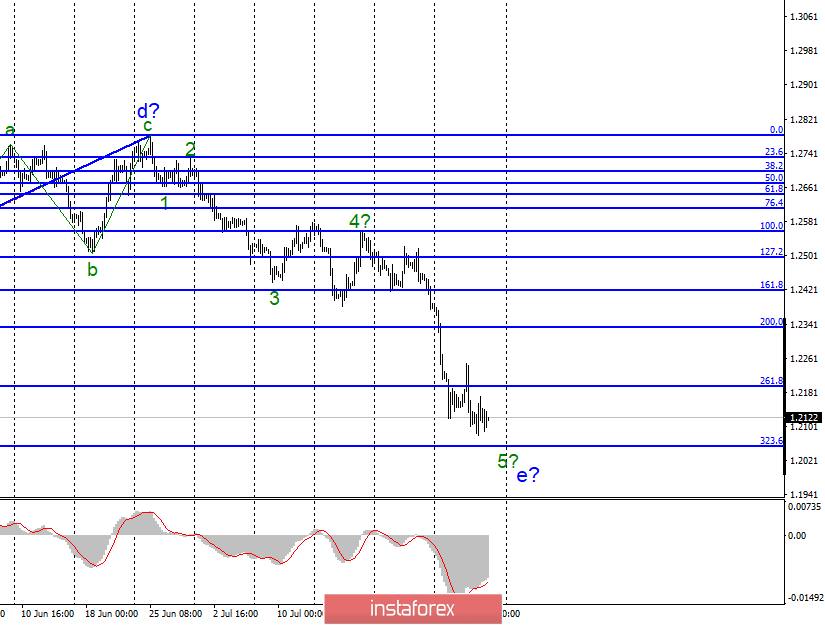

GBP / USD

The GBP / USD pair on August 1 lost about 25 basis points. The wave pattern of the instrument does not change and still involves the construction of a downward trend, which, given the news background, may become even more complicated. So far, everything looks as if the pound-dollar pair is preparing to complete the construction of wave 5 in e. If this is true, then an unsuccessful attempt to break through the 323.6% Fibonacci level could lead to the beginning of the construction of the upward trend. But at the same time, the situation with Brexit does not allow us to expect a serious strengthening of the pound. Of course, the currency cannot fall all the time. Time will come for a correction, during which, there may also be no reason to buy the pound. However, the news background remains completely negative for the couple.

Sales targets:

1.2056 - 323.6% Fibonacci

1.1830 - 423.6% Fibonacci

Purchase goals:

1.2783 - 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound-dollar tool suggests the continuation of the construction of a downward trend segment. Thus, I recommend selling the pair for each MACD down signal with targets located near the estimated mark of 1.2056. And in the case of a successful attempt to break through - with targets located at about 1.1830, which corresponds to 423.6% Fibonacci.