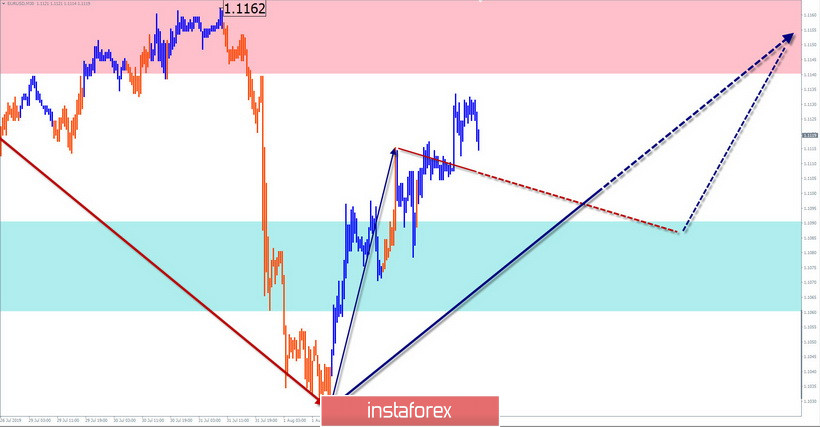

EUR/USD

The structure of the downward wave from June 25 looks completely completed, the proportions of the parts are observed. Since August 1, an upward movement has started, the wave level of which exceeds the scale of the rollback. It can be argued that a new short-term wave has begun.

Forecast:

The price rollback is expected at the next trading sessions. The most likely site of its completion is the support zone. By the end of the day, you can expect the change of the motion vector and attempt to break up.

Recommendations:

Selling euros today, it would be sensible to use only with intersessional trading. In the area of the support zone, it is recommended to monitor the signals of the instrument purchase.

Resistance zone:

- 1.1140/1.1170

Support zone:

- 1.1090/1.1060

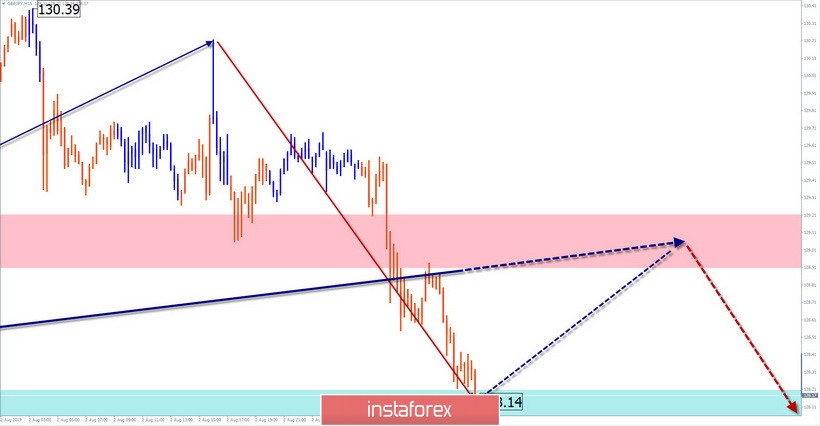

GBP/JPY

On the cross chart, the bearish rate dominates several TF. The last short-term wave from July 1 is at the end of the medium-term trend. The price has reached the upper limit of a wide support zone of a large scale.

Forecast:

Today, the most likely scenario will be a flat price movement along the support zone. By the end of the day, the probability of a price rise increases, not beyond the calculated resistance zone. A return to the main trend direction is expected tomorrow.

Recommendations:

When buying a tool today, you should be careful because of the high probability of sudden counter-movements. The best tactic is to refrain from entering the market of the pair for the time of rollback up, and to look for sell signals at its end.

Resistance zone:

- 128.90/129.20

Support zone:

- 128.20/127.90

Explanations to the figures: Waves in the simplified wave analysis consist of 3 parts (A-B-C). The last unfinished wave is analyzed. Zones show areas with the highest probability of reversal. The arrows indicate the wave marking according to the method used by the author, the solid background is the formed structure, the dotted ones are the expected movements.

Note: The wave algorithm does not take into account the duration of tool movements over time.