EUR/USD

On Monday, the euro jumped by 96 points on political tensions between the US and China. In response to new U.S. duties, China abandoned U.S. agricultural products and devalued the yuan over the past three days from 6.89 per dollar to 7.05 per dollar. In addition, the index of business activity in the US non-manufacturing sector in June showed a decrease from 55.1 to 53.7.

However, the euro's growth is only an initial reaction from the market regarding the complication of the trade and political situation, as it was before, in the future the dollar will suppress the temporary growth of European currencies, since the dollar is the safe-haven currency.

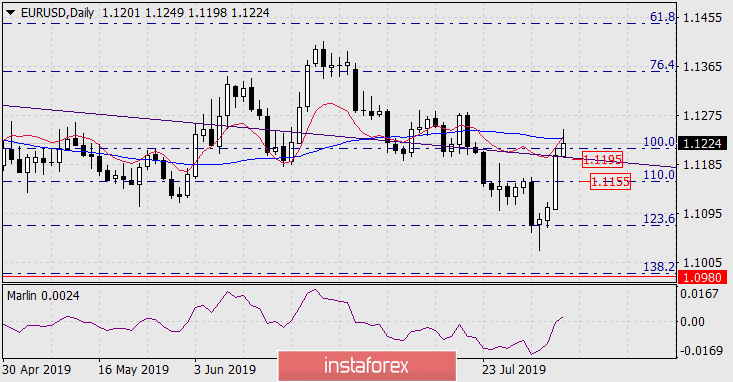

On the technical side, today in the Asian session, the euro reached the MACD line on the daily chart, the balance line is at the same point - resistance has strengthened. The signal line of the Marlin oscillator has moved to the growth zone, but in comparison with other indicators, this output may turn out to be false. Nevertheless, consolidating the price above the MACD line (above a high of 1.1250 this morning) may be the first signal of growth to the Fibonacci line of 76.4% in the 1.1360 area.

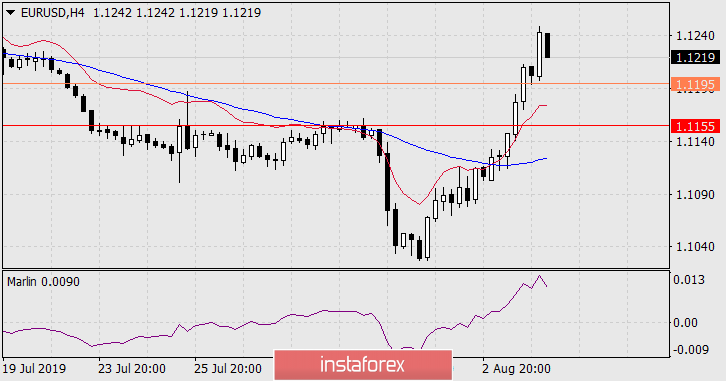

On the four-hour chart, the price is higher than the indicator lines of balance and MACD, the Marlin in the overbought zone. From current levels, the euro may go into correction. A price fall below the price channel line (1.1195) will greatly weaken the upward impulse of the euro, consolidating below it will allow the price to decline to the Fibonacci level of 110.0%, to 1.1155, and a lower price will resume the strengthening of lowering sentiment.