EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair strengthened above the correction level of 61.8% (1.1224), however, the formation of bearish divergence at the MACD indicator allowed to make a turn in favor of the US currency and start a fall in the direction of the Fibo level of 76.4% (1.1180). Yesterday, the whole day was held under the auspices of "business activity" in the EU and America. And I must say that the European indices of business activity were very weak. In the manufacturing sector, it has long been clear that there is a decline. Questions remained on the service sector and the so-called composite index. It turned out that in the service sector, there is also a slowdown, but there is no decline yet. Both indices in Germany showed a decrease compared to the previous month but remained above 50.0. In the European Union, the index in the service sector fell to 53.2, and the composite remained unchanged – 51.5. American business activity, on the contrary, was more positive. Only the ISM non-manufacturing index fell in July to 53.7 from 55.1. Other indices showed improvement. However, traders actively bought the euro in yesterday's trading, which raises some questions. Most likely, the growth of the EU currency in recent days is associated with such a factor as "acceleration" before a new fall. There are still no objective reasons for the strong growth of the European currency. And in this case, it is the bearish divergence that can send the euro/dollar pair to new lows.

The Fibo grid is built on the extremes of May 23, 2019, and June 25, 2019.

Forecast for EUR/USD and trading recommendations:

The currency pair EUR/USD has completed the closing under the Fibo level of 61.8% (1.1224). I recommend buying the euro/dollar pair today with a target of 1.1296, with the stop-loss order below the level of 1.1224, if the last peak of divergence is overcome. I recommend selling the pair with targets of 1.1180 and 1.1107, and with a stop-loss above the level of 1.1224, since a close was performed under the correction level of 61.8%.

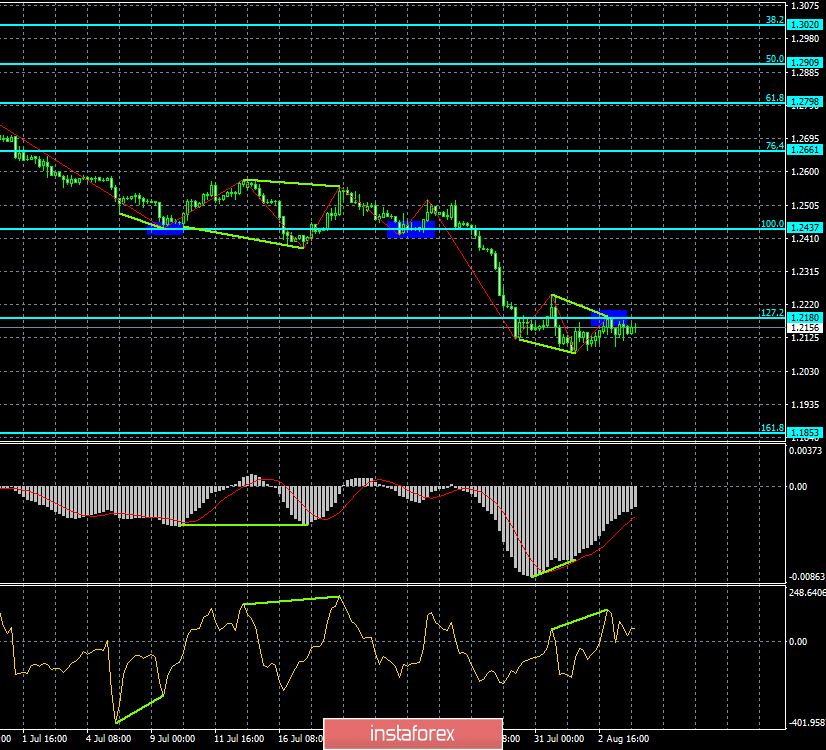

GBP/USD – 4H.

Today, I would like to consider the prospects of the English currency for the next month. It is clear that if the UK leaves the EU without agreements and transactions, then we will catch the pound sterling near price parity with the US dollar. But in any case, before the end of Brexit, there are almost 3 months left. And in these three months, the pound will respond to data related to Brexit, however, as in the last couple of years. The debate within the Parliament has already begun, according to which two opinions have emerged. Supporters of Boris Johnson say that nothing will prevent them to complete Brexit on time. Opponents, such as the Labor Party, say that they will do their best to prevent this. Moreover, in any case, the Prime Minister will not be able to withdraw the country from the EU without the approval of Parliament. And the Parliament is already skeptical and was set in the same way on Brexit "No Deal" as well. Thus, in the next three months, various kinds of information will appear, and each new message will move the box between the items "Brexit without a deal" and "new Brexit transfer". The further the flag is from the first point, the better the pound will feel in the short term. The bearish divergence of the CCI indicator in conjunction with a rebound from the Fibo level of 127.2% (1.2180) increase the likelihood of continued fall of the pair.

The Fibo grid is built on the extremes of January 3, 2019, and March 13, 2019.

GBP/USD – 1H.

As seen on the hourly chart, the pound/dollar pair generally continues to move between the correction levels of 200.0% (1.2227) and 261.8% (1.2057), after the formation of a bullish divergence in the MACD indicator. Of greater importance is the 4-hour chart, on which there are a pronounced rebound and divergence.

The Fibo grid is based on the extremes of June 18, 2019, and June 25, 2019.

Forecast for GBP/USD and trading recommendations:

The GBP/USD pair may resume the process of falling. Thus, I recommend selling the pair with the target of 1.1853, with the stop-loss order above the level of 1.2180, as the rebound from the correction level of 127.2% (4-hour chart) with bearish divergence was performed. I recommend buying the pair with the target of 1.2334 and with the stop-loss order below the level of 200.0%(hourly chart) if the closing is performed above the level of 1.2180.