The euro is falling, now ignoring the good statistics on Germany, which was published in the morning. It is possible that such a sharp increase in risky assets was a campaign for stop orders before the next wave of the bear market on the eve of lowering interest rates from the European Central Bank, which has nowhere to lower them, only to make it negative.

The trade conflict, which continues to intensify between the US and China, which I discussed in more detail in my morning review, will continue to maintain fairly high volatility in the markets.

As noted above, the growth of orders in Germany's manufacturing sector in June exceeded the forecast of economists, which is a good signal for the economy.

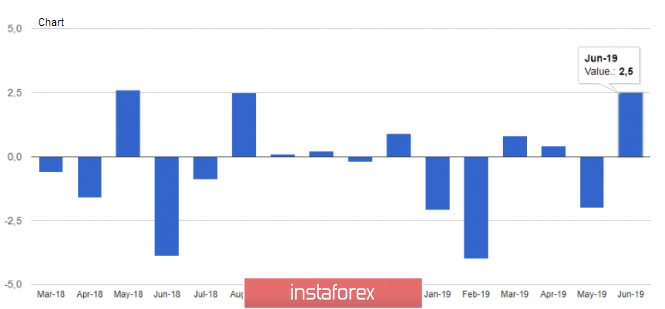

According to official figures, in June this year, compared with May, orders rose immediately by 2.5%, while a number of economists expected their increase to be only 0.3%. However, compared with June last year, orders fell by 3.6%.

The difficulties for the production sector in Germany and the eurozone remain, and to talk about a change of rate to a favorite in the current conditions of slowing global economic growth and the height of the next trade conflict is unlikely. The German Ministry of Economics, of course, is pleased that the downward trend of incoming orders in the manufacturing sector has slowed noticeably in the second quarter of this year, but it is still very far from the turning point in the industry.

Despite the fact that domestic orders decreased by 1.0% in June, while initially, the main support came from them, export orders grew by 5% at once. New orders from the eurozone declined by 0.6%, while orders from other countries rose by 8.6%.

Today, there will be a number of speeches by representatives of the Federal Reserve System, which may have some impact on the markets.

Today, the President of the Federal Reserve Bank of San Francisco, Mary Daly, has already spoken, who said that the problems of the world economy justify the decrease in the interest rate that occurred last week, but further pressure from the problems in trade, lower rates of other Central banks may be the basis for continuing the Fed's rate adjustment.

The President of the Fed-San Francisco does not believe that the world economy is moving to a recession, but, in her opinion, the uncertainty in trade has increased, which can cool the investment of companies, which, by the way, have recently slowed down so much in the United States.

Mary Daly also believes that there is no need for aggressive rate cuts, as consumer confidence and spending are at high levels, and the labor market continues to show strength. However, as we can remember from the recent statements of Fed Chairman Jerome Powell, this is clearly not enough to achieve a key inflation rate of about 2.0%, which retains a high chance of further easing monetary policy.

If after the rate decrease last week, the probability of the next decline was estimated at only 20%, then today, according to the futures quotes for the Fed rates, investors estimate this probability at more than 40%.

As for the technical picture of the EURUSD pair, as noted in the morning review, the correction of the euro will last to a large support level of 1.1170, and a larger sale will lead to a minimum area of 1.1140, where the lower limit of the upward price channel will be built. The task of buyers this week will be to return to the resistance of 1.1220 and its breakdown, which will return to the market players who put on strengthening risky assets and will lead to an update of the monthly highs in the area of 1.1290 and 1.1240.