The unexpected decision of the Reserve Bank of New Zealand to reduce the rate immediately by 50 basis points is the main news of the Asian trading session on Wednesday. This maneuver shocked traders as everyone was confident that the RBNZ would gradually mitigate monetary policy in August to 1.25% and in November to 1%, also at the beginning of next year (in spring) to 0.75%. However, the regulator decided to speed up this process, which caused strong volatility not only for the NZD/USD pair but also for the AUD/USD pair.

Just yesterday, it is noteworthy that quite good data on the labor market came out in New Zealand. Almost all the components left in the green zone and the unemployment rate fell to a record low of 3.9%. All indicators, including the growth rate of the number of employed, as well as the share of the economically active population and the level of wages, are indicators that turned out to be better than forecasts that allow the New Zealand dollar to show corrective growth. The pair with the American currency rose to the level of 0.6585. But already today, the NZD/USD pair tested four-year lows, already within the 63rd figure. In turn, the Australian dollar turned out to be more impressive. The Aussie collapsed to 10-year lows and currently testing the 66th figure.

It is worth noting that the head of the RBNZ Adrian Orr, arguing the decision of the regulator, focused his attention primarily on the slowdown in global economic growth. In fact, in his opinion, this will negatively affect the growth dynamics of key macroeconomic indicators in the country. First of all, we are talking about employment and inflation. According to Orr, "global economic activity continues to weaken while reducing demand for New Zealand's goods and services." Recent events have only aggravated the overall fundamental picture. The trade war between China and the United States continues to gain momentum despite weak attempts by Beijing and Washington to calm markets. Hence, despite yesterday's statements by the People's Bank of China, the yuan and the dollar today returned to their 11-year low, falling to 7.047 after yesterday's corrective pullback to 7.012. As you can see, the USD/CHF pair continues to stay above the psychologically important mark 7, reflecting the true (and not declared) intentions of the PRC.

By the way, the commodity market did not "succumb" to the reassuring rhetoric of representatives of the Chinese regulator. The price of Brent crude oil was fixed at $60 (currently $58.88), while WTI was trading at $53. The cost of iron ore is also actively decreasing. If a week ago, a ton of this raw material was estimated at $120, then today this figure has dropped to $ 94. Copper is decreasing in a similar way, as well as LME a few weeks ago. Copper was at $6050 and now, the cost of a ton is $5627. Moreover, the devaluation of the renminbi will affect not only the commodity market and its affiliated corporations. After all, do not forget that China is a colossal market for a wide variety of goods, including dairy products strategically important for New Zealand.

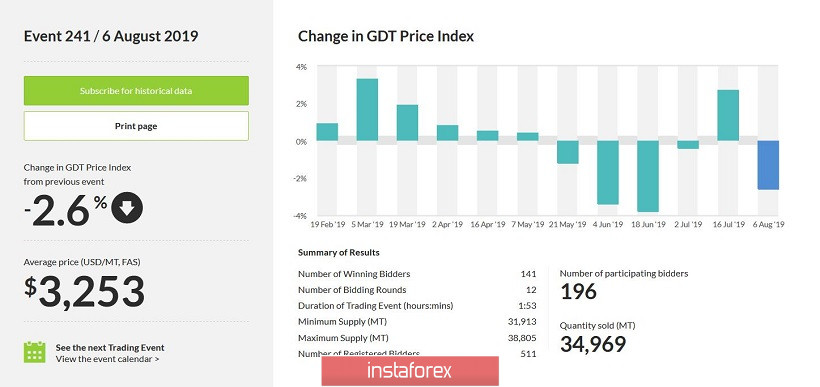

It's worth noting that the New Zealand dollar is usually very responsive to the dairy industry news. The determining factor in this area is the Global Dairy Trade auction, which essentially determines the value of dairy products. Hence, according to the results of the last auction, which was held yesterday, the negative dynamics of the price index for dairy products was again recorded. This time, the decrease was 2.6%. New Zealand is the world leader among dried milk exporters. Its share in the export of dried milk products is more than 30%. For other positions, the situation is almost similar. The main consumers are the European Union and China and the general situation depends on their demand. Therefore, the potential decline in China's purchasing power is exerting strong background pressure on the New Zealand currency.

In turn, the Australian dollar collapsed to 2009 levels because of concerns about further actions of the RBA. Traders are worried that members of the Australian regulator will follow the example of their New Zealand colleagues and will also cut interest rates by 50 basis points in the fall. These fears are not without reason. After all, both the head of the RBA, Philip Lowe, and the head of the RBNZ, Adrian Orr, did not exclude further steps towards easing monetary policy. How these steps will be is an open question.

From a technical point of view, the potential for the development of a bearish trend of the NZD/USD pair remains, despite the fact that the downward impulse has faded somewhat at the moment. The announced probability of another round of rate cuts will put pressure on the Kiwi, causing a downward movement. On all the "higher" timeframes (except MN), the pair is located on the lower line of the Bollinger Bands indicator and under all the lines of the Ichimoku indicator. The support level, which is the goal of the downward movement, is the lower line of the Bollinger Bands indicator on the monthly chart that corresponds to the "round" mark of 0.6300.