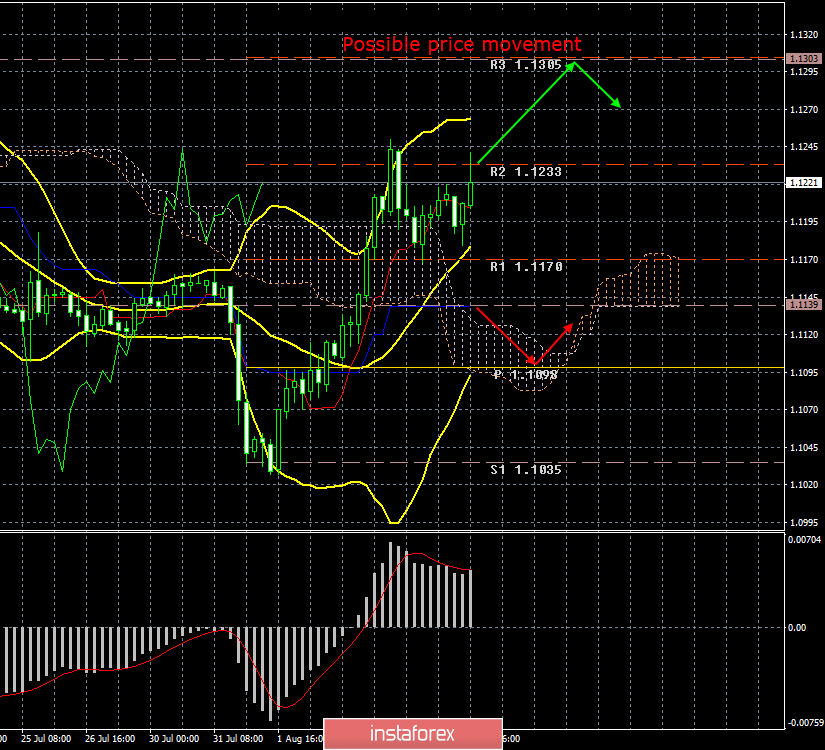

4-hour timeframe

Amplitude of the last 5 days (high-low): 102p - 69p - 46p - 110p - 82p.

Average amplitude over the last 5 days: 82p (71p).

The EUR/USD currency pair is trying to resume the upward movement on Wednesday, August 7, and we cannot say that it does not succeed. The pair returned to the local high of August 6 and in the next few hours can break through and overcome it. The most interesting thing is that the euro did not have any growth catalysts today. Not a single macroeconomic report, single new message from Donald Trump or Mario Draghi or Jerome Powell, in general, from the first persons of the European Union and the US. However, bulls re-energized and began weak purchases of the euro. However, until the euro/dollar pair has not broken the previous high, there remains a high probability that the upward trend will end and a transition to the new downward trend. This option is supported by a fundamental background, which is still very difficult to interpret in favor of the euro. Yes, the Fed lowered the rate; yes, preparing to do it several more times; yes, the trade war between the United States and China is gaining momentum; Indeed, macroeconomic statistics have not been the best in recent months. However, we must consider all this data through the prism of the euro currency. In addition, in our opinion, things in the European Union, which is the issuer of the euro, are worse. The interest rate is already 0.0%, the deposit rate is even at a negative level, and it can be worse at the next ECB meeting, which will create financial problems for commercial banks that will be forced to pay more for placing money on deposits. Moreover, a long-term bank lending program is being prepared to launch in order to support the liquidity of the banking system. Inflation is at a disappointing level, business activity in the manufacturing sector indicates a decline. Today, the indicator of industrial production in Germany - the locomotive of the European economy - qualitatively reflects the state of things. The reduction in annual terms reached 5.2% and 1.5% in monthly terms. Thus, we believe that after the correction, no matter how strong it may be, bears will again take the initiative into their own hands.

Trading recommendations:

EUR/USD completed a downward correction. Thus, traders are advised to buy the euro while aiming for the resistance level of 1.1305 either after the MACD indicator turns up, or after overcoming the R2 level - 1.1233.

In addition to the technical picture, fundamental data and the time of their release should also be considered.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.