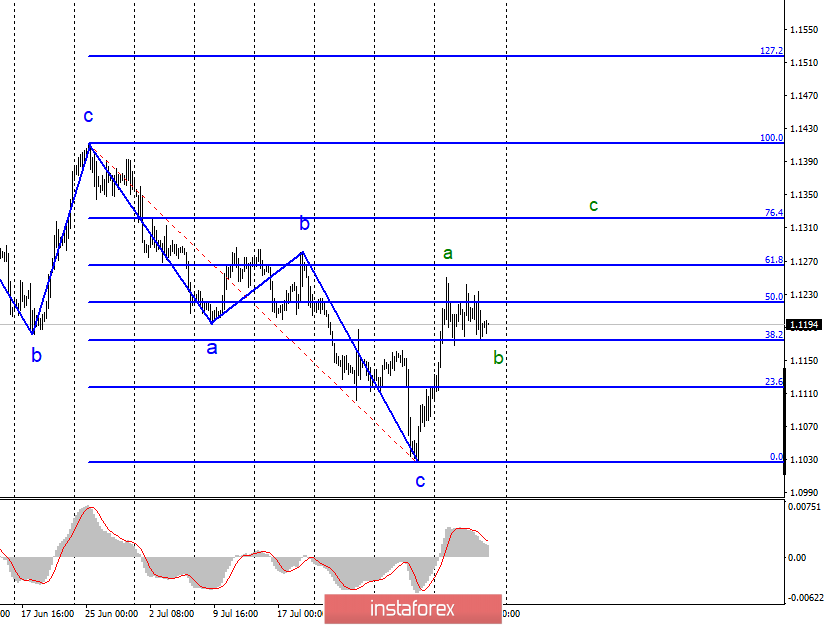

EUR / USD pair

On Thursday, August 8, the EUR/USD pair ended with a decrease of 20 basis points. Thus, the current wave marking, as well as the amplitude of the euro-dollar pair in recent days suggests that the instrument is in the process of constructing the estimated wave b of the upward trend section, which originates on August 1. If this is true, then the growth of the Euro currency will resume within the framework of the wave with goals located between 13 and 14 figures. At the same time, the pair will definitely need a news background to further increase. To do this, markets must receive positive news or economic reports from the eurozone or negative from America. But on Friday, August 9, no reports are planned, respectively. The week can end calmly without sharp and strong movements in the foreign exchange market. I believe that the chances of the euro rising to 13 and 14 figures are quite large since if you look at the chart for the last 8 months. It becomes clear that the pair are building mainly "triples" and diagonal "fives". In the literal sense of the word, there were no trends for this period. Now, therefore, it is time to build the "triple" up.

Purchase targets:

1.1264 - 61.8% Fibonacci

1.1322 - 76.4% Fibonacci

Sales targets:

1.1027 - 0.0% Fibonacci

General conclusions and trading recommendations:

The euro/dollar pair has moved to the construction of an upward trend section. Thus, I recommend buying a pair with targets near the 1.1264 and 1.1322 marks, which is equal to 61.8% and 76.4% Fibonacci. For each upward signal of MACD, calculated on the construction of an upward wave after completion b.

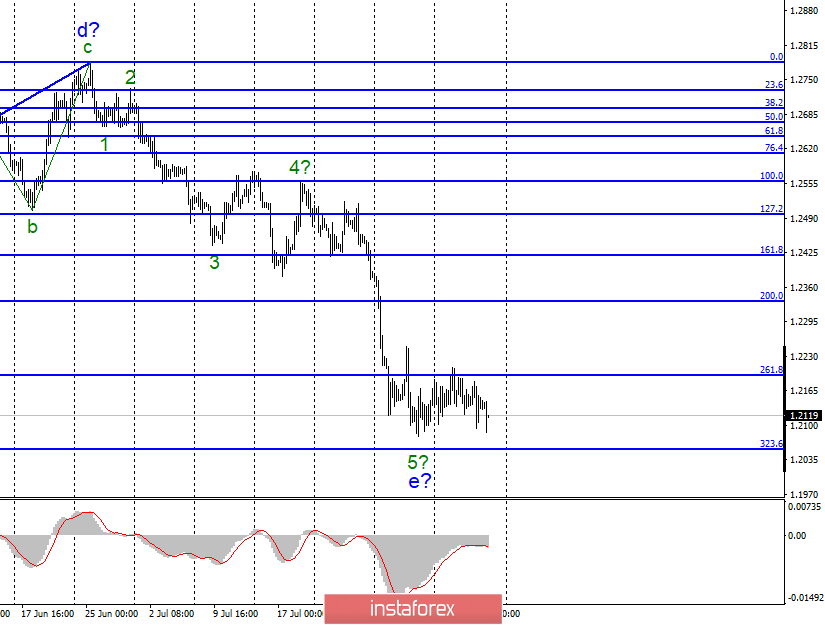

GBP / USD pair

Yesterday, the GBP/USD pair fell by another 15 basis points and more and more is approaching the resumption of building a bearish trend section, which takes on a very complicated look. However, I have repeatedly said that the news background for the pound remains such that it is very difficult for the Forex currency market to consider purchases. Today came out economic reports on GDP in the UK. On a monthly basis, GDP growth in June amounted to 0.0%. According to preliminary estimates, the quarterly decline was 0.2%, while the annual growth was 1.2% against market expectations of + 1.4% and the previous value of + 1.8%. Industrial production in June fell by 0.1% mom, and this is better than market forecasts (!!!), year-on-year losses amounted to 0.6%. Thus, there are no questions why traders again sell the pound at Friday's auction and can continue to do so for a very long time despite the widespread belief that the pound is oversold. A successful attempt to break through the 323.6% Fibonacci level will indicate the market's readiness to continue building the downward trend section.

Sales targets:

1.2056 - 323.6% Fibonacci

1.1830 - 423.6% Fibonacci

Purchase targets:

1.2783 - 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound/dollar instrument suggests the completion of the construction of the downward section. However, until the successful attempt to break through the 261.8% Fibonacci level, the bears hope that the e-wave will become more complicated. Thus, I recommend selling the pair with downward MACD signals located near the calculated mark of 1.2056 and below. Only a successful attempt to break through the level of 1.2192 will suggest a willingness to build a correctional set of waves.