The next round of the trade war between the United States and China led to an increase in the EUR/USD quotes. It would seem that the escalation of the conflict on the model of last year negatively affects the single European currency. It would seem that the escalation of the conflict on the model of last year should negatively affect the single European currency. Indeed, the weakness of external demand, primarily Asian, puts the wheel in the wheel of German exports and threatens to plunge the leading eurozone economy into recession. In fact, the American economy practically did not respond to trade wars due to a large-scale fiscal stimulus, then in 2019, the situation changed.

The Fed considers international risks as the main factor in making adjustments to monetary policy. Under their influence, the US economy is likely to slow down from almost 3% last year to 2-2.3% this year. Moreover, the most serious inversion of the yield curve since 2007 signals an approaching recession. Experts at the Wall Street Journal and Bloomberg estimate her chances over the next 12 months at 33-35%.

If after the words of Jerome Powell at a press conference saying that the US dollar has grown. This is after the results of the July FOMC meeting, where a reduction of the rate by 25 bp is not the beginning of the monetary expansion cycle. Then, the Fed Chairman's clarification that the rate can be reduced more than once and was knocked down. Indeed, if the easing of monetary policy is of a preventive nature, as in the 90s of the last century, then we can expect a decrease in borrowing costs by another 50-75 bp.

Thus, the US economy and the dollar are sensitive to trade wars. At the same time, the growth of USD/CNY is higher than the psychologically important mark of 7 and the related charge of currency manipulation in the States of China threw EUR/USD quotes upward. Many considered the devaluation of the renminbi to be Beijing's response to Washington's new duties but in reality, it was just a demonstration of weapons.

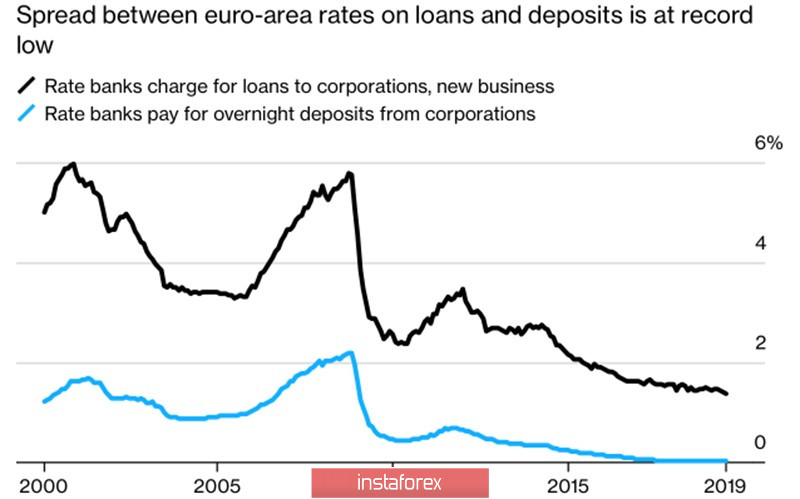

An important driver for the growth of the main currency pair is the potential for monetary expansion. If the Fed has room to maneuver, the ECB rates are already negative, and restrictions on the purchase of assets do not allow talking about the high efficiency of QE. The differential of rates on the issued and attracted resources of commercial banks has fallen to historically low levels, and if the European regulator loosens its monetary policy, even more, you will not envy the banks of the Old World.

The dynamics of interest rate differentials by European banks resources

In my opinion, the US dollar is still afloat thanks to strong statistics in the United States. But if the indicators are weak, the correction of the USD index will gain momentum. In this regard, the release of US retail data for July deservedly attracts the attention of investors. However, there is the publication of statistics on German GDP. Bloomberg experts predict that the leading eurozone economy in April-June will go minus quarterly.

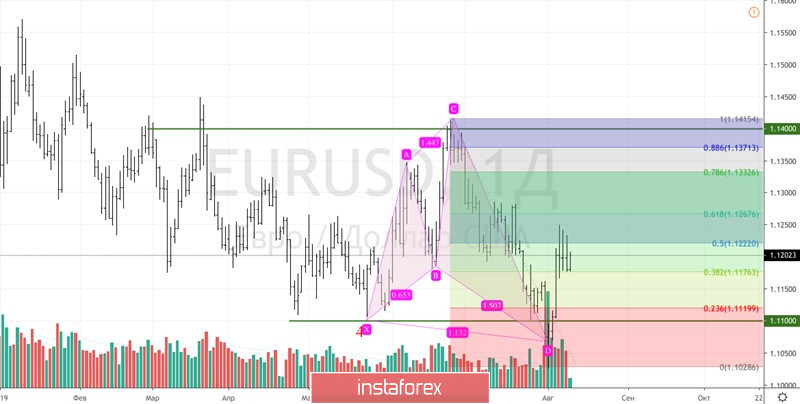

Technically, there is a correction to the CD wave to levels of 38.2%, 50% and 61.8% as part of the transformation of the Shark pattern to 5-0. The rebound from the above resistances makes sense to use for sales. On the contrary, a breakthrough of the EUR/USD pair above 78.6% and 88.6% will be a signal for the formation of long positions.

EUR / USD daily chart