4-hour timeframe

Technical data:

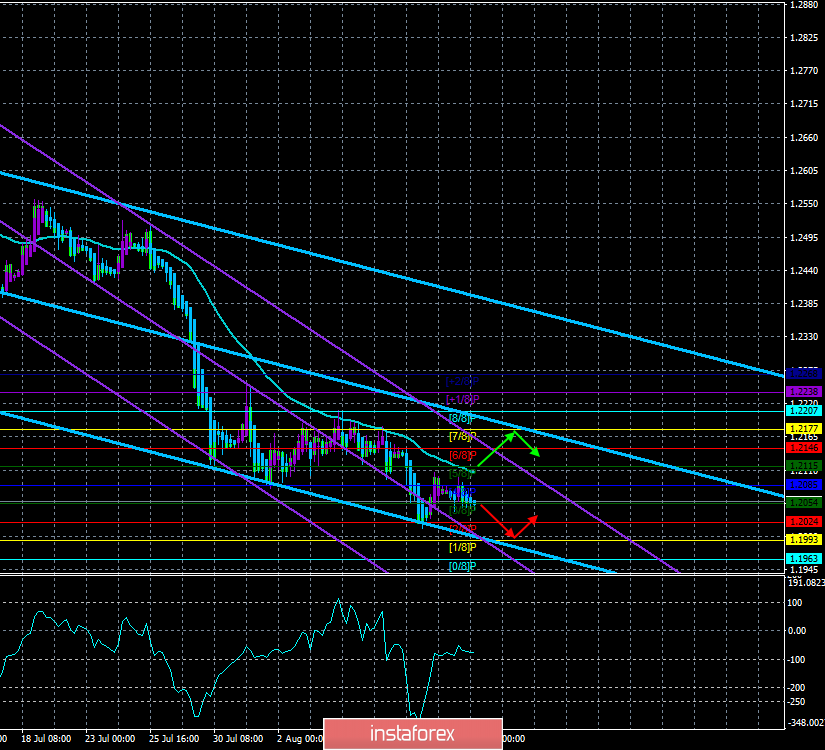

The upper linear regression channel: direction – down.

The lower linear regression channel: direction – down.

The moving average (20; smoothed) – down.

CCI: -71.6180

Just yesterday, we wrote that Boris Johnson's initiatives for an early exit from the EU "at any cost" are not supported by all politicians, experts, and the population. Today, despite the title of this article, we can say that there is confirmation of this assumption. According to a survey of 2000 Britons, 54% of them supported the fastest possible "divorce" with the European Union on any terms. However, there are still about 46% who do not support this option. The alignment of forces was also approximately at the referendum of 2016, when the majority decided on Brexit. And the "majority" is 52%. Thus, we continue to believe that too many opponents of the "hard" Brexit will not allow Boris Johnson to freely suspend the work of Parliament and carry out Brexit alone. A survey of only 2,000 Britons, which is unlikely to include Scots and Irish, who are a priori opponents of any Brexit, cannot reflect the real situation. Today, in the UK, the consumer price index for July will be published, which, according to experts, may slow down to 1.9% y/y. However, in any case, the pound is not paying much attention to macroeconomic statistics from the UK. The pound/dollar pair may react to US reports, as this is a new reason to sell the pound, but no reports and news from the States are expected on August 14.

Nearest support levels:

S1 – 1.2054

S2 – 1.2024

S3 – 1.1993

Nearest resistance levels:

R1 – 1.2085

R2 – 1.2115

R3 – 1.2146

Trading recommendations:

The GBP/USD pair is trying to resume a downward trend. Therefore, it is now again recommended to sell the pound with targets at 1.2024 and 1.1993 before the new reversal of the indicator Heiken Ashi up. Buying the pound/dollar pair is still impractical and risky.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator regression window.

The moving average (20; smoothed) – blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.