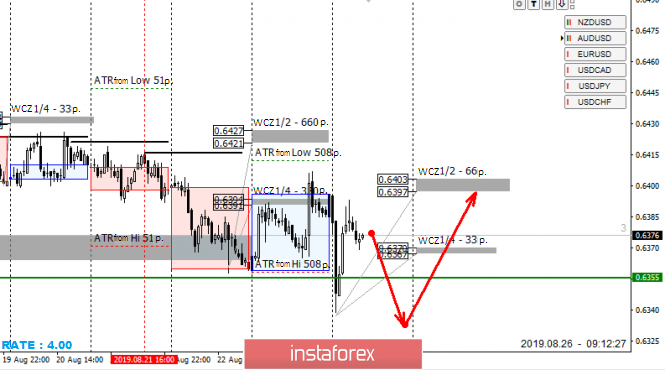

Today's fall of the pair led to the test of the monthly control zone in August. This makes it possible to talk about increasing the probability of forming a reversal upward model. If the closing of today's trading will occur above the WCZ 1/4 -0.6370-0.6367, it will be the first signal to buy the tool. The main resistance will be WCZ 1/2 0.6403-0.6397, where the fate of the downward medium-term model will be determined.

If the closing will occur above the WCZ 1/2, this will allow us to talk about the end of the downward phase and the transition to the reversal, where medium-term purchases of the instrument will come to the fore.

An alternative model will be developed if the pair starts to decline again and a repeated test of the monthly control zone will occur. In this case, the most favorable purchase prices will be obtained. It is important to understand that the probability of closing trading in August within the monthly control zone is 70%.

Daily CZ - daily control zone. An area formed by important data from the futures market that changes several times a year.

Weekly CZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. An area that reflects the average volatility over the past year.