Despite the fact that the Fed Chairman did not signal the direction of the Fed's policy, making only a number of indirect statements on this topic, the US dollar fell against a number of world currencies after weak data on the US real estate market, as well as the introduction of retaliatory duties by the Chinese government.

During his speech, the Fed Chairman said that it would be appropriate to act to maintain economic growth, even though the prospects for the US economy have improved since the beginning of this year. Powell expressed concern about the uncertainty in international trade, which is leading to a slowdown in the global economy.

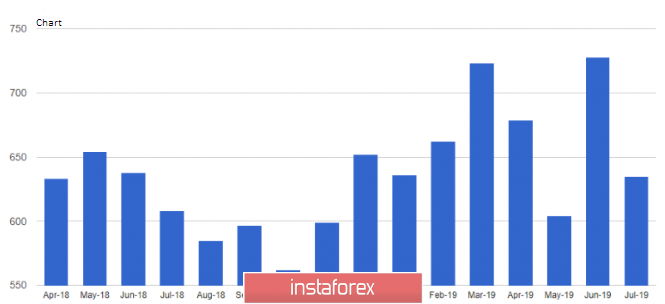

As noted above, Americans began to acquire much less new homes. According to a report by the US Department of Commerce, despite low mortgage rates and a strong labor market, sales in the primary housing market in July this year fell sharply by 12.8% compared to the previous month and amounted to 635,000 homes a year. Economists had expected sales of 650,000. Meanwhile, the average price of new housing in the United States fell to $ 312,800 in July from $ 327,500 a year ago.

Data on the growth of activity in the area of responsibility of Fed-Kansas City were ignored by market participants. According to the report, the Fed-Kansas City composite index for services strengthened to 17 points in August from -1 point in July. The growth was due to higher activity in the restaurant business and the professional services sector. In terms of expectations for future activity in services, they rose to 18 points in August from 14 points in July.

Immediately after the speech of the Chairman of the Fed, the yield of Treasury bonds fell sharply, and gold rose. This situation is directly related to the fact that investors continue to predict further rate cuts in the United States, reacting to the slowdown in the global economy. The yield on 10-year Treasury bonds fell to 1.593% against 1.605% due to sharp demand, and gold strengthened to $ 1,550 per ounce.

As for the technical picture of the EURUSD pair, it underwent a number of changes at the end of last week. Now, buyers of risky assets are concentrated at the level of 1.1160, the breakthrough of which will lead to a new push of the euro up to the highs of 1.1190 and 1.1230. If the bears try to build at least some downward correction that may occur as a result of the meeting at the G7 summit, the first support levels will be viewed in the area of 1.1110 and 1.1090.

The Canadian dollar remained traded in a narrow side channel, in which it had been all last week after the release of the report that retail sales in June remained unchanged compared to May.

According to a report by the National Bureau of Statistics of Canada, retail sales in June 2019 remained unchanged from the previous month and amounted to 51.35 billion Canadian dollars. Economists had expected sales to fall by 0.3%. Compared to the same period of the previous year, sales in June increased by 1.0%.