Mass agitation and disinformation cannot live a day without scandals, intrigues, and investigations. Especially when it comes to financial markets. But the trouble is, the Federal Reserve System, following the results of the last meeting of the Federal Committee on Open Market Operations, killed the whole intrigue most meanly. Not only was the decision to lower the refinancing rate unanimous, but some insolent people voted for its increase. And in the text of the minutes of the last meeting of the Federal Committee on Open Market Operations, there is no indication of the possibility of another reduction in the refinancing rate before the end of this year. So, the media propaganda and misinformation had to come up with intrigue. Donald Trump came to their aid, who constantly criticizes Jerome Powell and even called him America's main enemy, just for the fact that the head of the Federal Reserve is in no hurry to reduce the refinancing rate. Over the past week, these same mass media of agitation and misinformation have carefully convinced everyone that during their speech in Jackson Hole, Jerome Powell will at least hint at another decrease in the refinancing rate this year. It does not matter that during his public speeches, the head of the Federal Reserve never spoke directly about the regulator's plans regarding the refinancing rate. The main thing is to warm up the audience and create the impression of a certain epoch-making of what is happening.

The efforts were not in vain, and investors nevertheless found in Jerome Powell's words what all the mass media of agitation and misinformation so screaming. As they say, whoever seeks will always find. The reason for the hysteria was a small passage by Jerome Powell that after the last meeting of the Federal Committee on Open Market Operations, global risks had slightly increased. The head of the Federal Reserve pointed to the strengthening of the trade conflict with China, the slowdown in economic growth in Germany, and all the same China, as well as the growing risks of unregulated Brexit. Jerome Powell did not neglect even the resignation of the Italian government. That is, those who want to see hints of a reduction in the refinancing rate immediately regarded it as necessary. If the risks grow, then the rate will be reduced. And no one was confused by the fact that immediately after listing the increasing risks, Jerome Powell noted the good state of the American economy. Moreover, the state of the labor market, which he called the best in history, was almost the main theme of his speech. At least, that's what he talked about most of the time. The head of the Federal Reserve System separately focused on the fact that the rate of job creation exceeds the rate of growth of the labor force. That is, Jerome Powell bluntly said that even if the dynamics of the labor market worsen, this is far from a cause for concern. And even inflation cannot be a reason to reduce the refinancing rate, as medium-term forecasts show the possibility of its acceleration to 1.9%. That is, just in time for the target levels of the Federal Reserve System. But all the same media propaganda and misinformation is a great retort, the endless whining about the impending recession. So, investors, who were actively driving a panic into their heads, heard in the words of Jerome Powell exactly what they were inspired by the media and misinformation. This is reflected in the rapid decline in the cost of portraits of dead presidents of the United States.

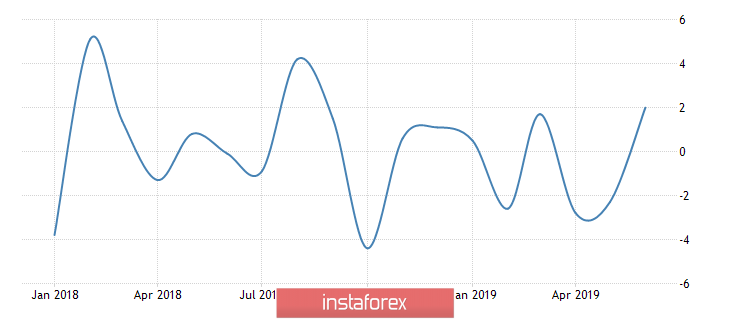

It is also funny that against this background, everyone completely forgot about the American statistics, which showed a decrease in sales of new homes as much as 12.8%. So there was a reason for lowering the dollar, at least for a while. The most important thing is that since the dollar fell for the most part on emotions, the statistics will remain without attention, and a rebound is simply inevitable. Moreover, it has already begun. And it could last all day, as durable goods orders data comes out in the evening, which could show a 1.1% increase, once again questioning hysterical cries about the recession on the verge.

Dynamics of durable goods orders in the United States:

Thus, we should expect a steady decline in the single European currency to 1.1075.

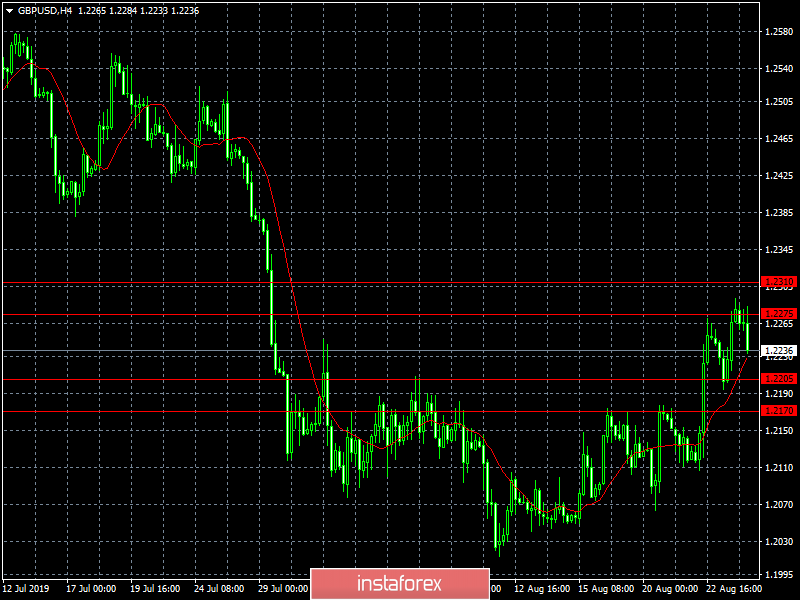

The pound should also fall, and the reference point is the mark of 1.2200.