4-hour timeframe

Technical data:

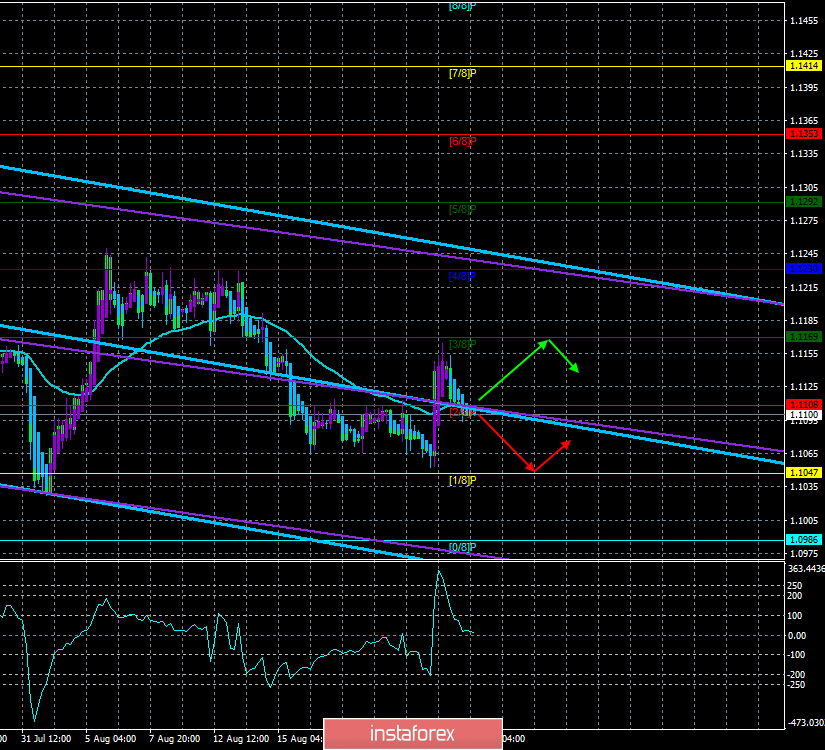

The upper channel of linear regression: direction-down.

The lower channel of linear regression: direction-down.

The moving average (20; smoothed) - sideways.

CCI: 10.9672

The second trading day of the week begins, and the EUR/USD currency pair has already slipped back below the moving average line. The strength and desire of the euro were enough for exactly one jump up. On Monday, August 26, buyers felt that the current strengthening of the euro is the maximum possible and began to close those meager purchases that were opened on Friday. And in principle, this decision is absolutely consistent with the trading strategy that was chosen for the euro/dollar by most traders for a long time. Namely, the long-term sales of the euro and the purchase of the dollar until the balance of power of the monetary policies of the EU and the United States does not change in the direction of the first or at least does not equalize. Since both the Fed and the ECB have declared their readiness to reduce the key rate, and the ECB has also announced the revival of the quantitative stimulus program, the general fundamental background continues to support the dollar and push the pair down.

Recently, more attention has to be paid to the events taking place in Italy, where a political crisis is brewing no less strong than in the UK. Without going into details, the situation in certain circumstances may fail another exit, now ItExit. Already today, members of the Italian Parliament must form a new government, otherwise, dissolution and early parliamentary elections will follow. If we add to this all the problems and disagreements associated with Brexit, there is another reason for the systematic decline of the European currency.

Of the macroeconomic publications on Tuesday, there is almost nothing to note. There will be only a report on German GDP for the second quarter, not very interesting for traders, as well as the consumer confidence index in the US for August, which is also unlikely to cause a strong reaction from forex market participants.

Well, to top it off, let's pay attention to the technical picture, which has changed again. Since the EUR/USD pair returned to the area below the moving average, the mood on the currency market is again "bearish". As a consequence of this recommendation, "sell" again.

Nearest support levels:

S1 – 1.1047

S2 – 1.0986

S3 – 1.0925

Resistance levels:

R1 – 1.1108

R2 – 1.1169

R3 – 1.1230

Trading recommendations:

The euro/dollar pair fixed below the moving. Thus, it is now recommended to trade downwards with the first target of 1.1047. Bears may soon lower the euro to two-year lows. As for the pair's purchases, the bulls' last attempt to start forming an upward trend failed.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator window.

The moving average (20; smoothed) – blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.