The euro continued to decline yesterday and in the afternoon, after the report on the growth of durable goods orders in the United States, indicating a good state of the economy and a high level of consumer confidence. However, the demand for the US dollar remains quite low due to the recent aggravation of the US-China trade conflict, which will not end soon. The uncertainty surrounding US-China trade relations continues to put pressure on the confidence of business and investors around the world, as noted yesterday during the G7 summit.

The only thing that will remain in demand soon is the assets of asylum, which include the Japanese yen and gold, as the new mutual protective duties between the US and China, which were announced at the end of last week, further worsened the prospects for the world economy.

Some experts also point out that the pressure, which now affects only the manufacturing sector, could easily spread to the service sector if the US-China trade conflict continues to worsen.

As noted above, orders for durable goods in the United States in July this year were better than economists' forecasts and increased compared to the previous month.

According to the US Department of Commerce, orders rose by 2.1%, which was directly related to orders for civil aircraft and spare parts, where the increase was 47.8% compared to June. However, excluding transport equipment, durable goods orders fell by 0.4%.

Reports on activity in the area of responsibility of various banks of the Fed were ignored by the markets.

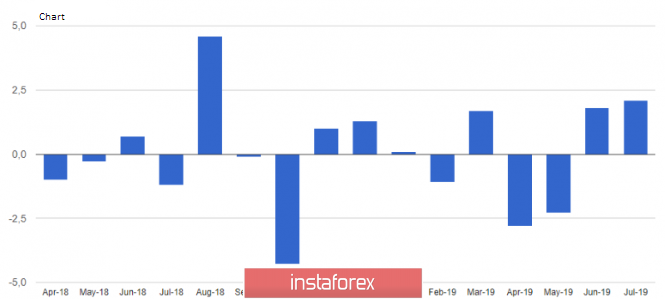

According to the Federal Reserve Bank of Chicago, in July, the index of national activity fell to -0.36 points against 0.03 points in June, and the main negative contribution was related to the index of production. The moving average index of national activity for three months in July amounted to -0.14 points against the June value of -0.30 points.

Production activity in the area of responsibility of the Federal Reserve Bank of Dallas increased in August. According to the data, the overall index of business activity in August was 2.7 points against -6.3 points in July. Expectations of growth and prospects for doing business have also increased.

The main increase was provided by the production index, which in August was 17.9 points against 9.3 points in July. The new orders index also rose to 9.3 points.

As for the technical picture of the EURUSD pair, the market is in "limbo". If yesterday it was possible to talk about the likely continuation of the growth of risky assets, today, after the return of the pair to the support of 1.1120, the prospects have deteriorated. Bulls will need a lot of effort to cope with the level of 1.1120, as only above this range it will be possible to talk again about the continuation of the growth of the euro to a maximum of 1.1160. The breakdown of the support of 1.1080 will provide the bears with new forces that will push the trading tools already in the area of the August lows.

The Australian dollar ignored the report on the consumer confidence index, which, despite all the economic shocks, rose. According to the data, the index rose by 1.2% last week, as a result, confidence exceeded the long-term average. The rise in sentiment and the index itself came even amid trade conflicts that are slowing the growth of the global economy, as consumers are pleased with the recent decline in interest rates and taxes. Sentiment about the current financial situation has also improved. Let me remind you that the RBA lowered interest rates in June and July this year, explaining this by the deterioration of the prospects for the world economy.

Yesterday, during a conference with economists in Canberra, RBA deputy head Debelle reiterated that there are significant threats to the global trading system, and a significant risk to Australia and the world comes from the trade conflict. Thus, we should not rule out further easing of monetary policy and count on the recovery of the Australian dollar in the medium term.