One can only regret the various media agitation and misinformation that are simply making unthinkable efforts to make everyone believe in the imminent reduction of the Federal Reserve refinancing rate, even justifying the inevitability of this decision in the form of an impending recession, which can be avoided only by reducing the refinancing rate. There is a feeling that they are trying to convince the Federal Reserve System itself. It is as if the owners of these most honest mass media of agitation and misinformation gained loans and now it would be nice for them to reduce the cost of their service. This noble purpose attracted even Donald Trump, who called Jerome Powell the main enemy of America (not the second) after China, and the first. But all their efforts go down the drain. Not only that, in fact, Jerome Powell ordered everyone to relax and have fun as a reduction in the refinancing rate is not yet expected since there are no prerequisites for this banal. After all, the labor market is probably in the best condition in history and if inflation is decreasing, it is not strong but not for long.

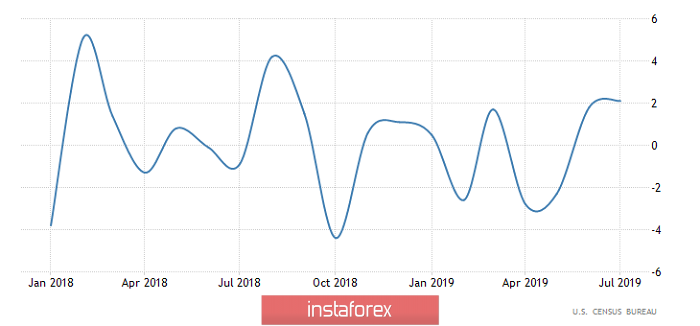

True, investors took the whole weekend to realize this fact. So even appeal to the impending recession is somehow not with your hands, otherwise you can go for a stupid one. Here the fact is that orders for durable goods showed an increase of as much as 2.1% instead of the expected 1.1%. Well, these same orders indicate future growth in industrial production and retail sales. After all, if the goods are ordered, then they are going to buy them and even make an advance payment. And in order to provide them to the customer, these same goods need to be produced. Well, since orders are growing, then there is simply nothing to wait for a decline in economic activity. And if there is no decline, then recession is nowhere to come from. Here is such universal sadness.

Yet, it took investors the whole weekend to realize this fact. It's also a way of appealing to the coming recession, or you can get away with it. The point is that the orders for durables showed growth of as much as 2.1% instead of the expected 1.1%. Well, these same orders indicate the future growth of industrial production and retail sales. After all, if the goods are ordered, then they are going to buy and even make advance payment and in order to provide for the customers, these same goods need to be produced. Well, since orders are growing, then there is simply no reason to wait for a decline in economic activity. But if not reduced, there is nowhere to go but recession -that's the universal sadness.

Dynamics of orders for durable goods in the United States:

Now, everyone is taking a wait and see attitude since in the next couple of days the macroeconomic calendar is practically empty. Today, you should pay attention only to the data on approved mortgages in the UK. The number of which should increase from 42,653 to 42,800, as well as data from S&P/Case-Shiller on housing prices in the United States. The growth rate of which may remain unchanged. However, both the first and second indicators are not so important and their impact on the markets is extremely limited. In other words, everyone is waiting for Thursday, when the second estimate of the United States GDP in the second quarter will be published. That's when everyone starts whining again about the inevitability of a recession and the need to urgently reduce the Federal Reserve's refinancing rate. After all, even the first assessment showed a slowdown in economic growth.

US Gross Domestic Product (GDP) Dynamics:

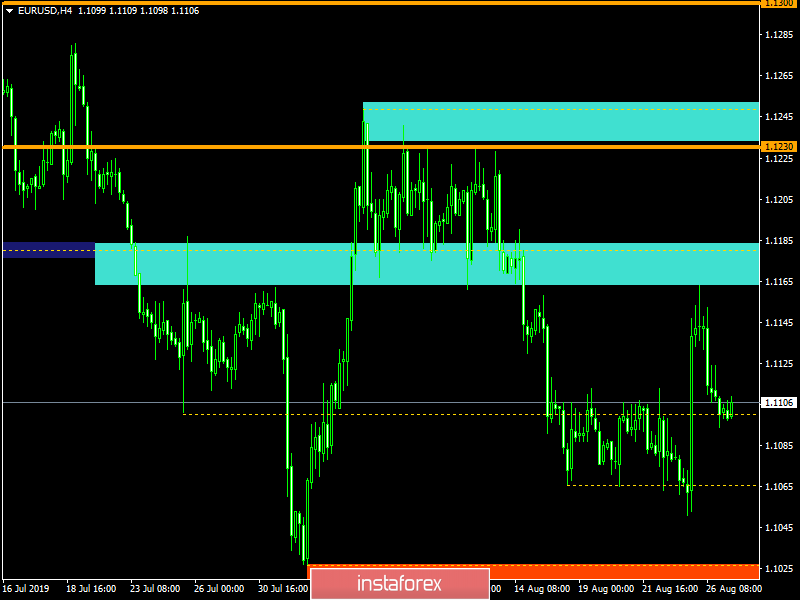

The Euro/Dollar currency pair entered the recovery phase after Friday's jump, returning us to the previously designated 1.1100 accumulation point. It is likely that there will be a temporary amplitude within the level of 1,100, with a deviation of 20points that may remain until the end of the day.

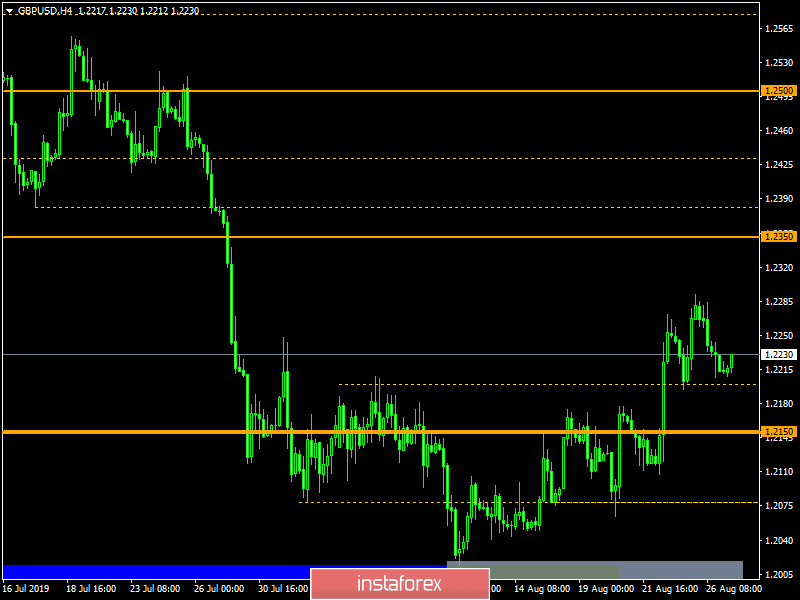

The Pound/Dollar currency pair demonstrates a similar mood, returning us to the control point of 1.2200. It is likely to assume that before the breakdown of the level of 1.2200, we will see a temporary fluctuation above this value while aiming at the range of 1.2200/1.2240.