The oil market has been pretty turbulent in the last days of August. But could it be otherwise if China and the United States raise tariffs and then announce their readiness for negotiations and an agreement? Black gold is highly sensitive to the factor of reduction in global demand and turns a blind eye to the decline in OPEC production, sanctions against Iran and Venezuela and weather disasters in the Gulf of Mexico. Bulls are in no hurry to carry out attacks, as they understand that all optimistic statements by the White House may not be worth a penny. The trade conflict seems to be a long-running factor for investors: it is entirely possible that Washington and Beijing will not be able to conclude an agreement until the 2020 presidential election. However, bears also have their own vulnerabilities.

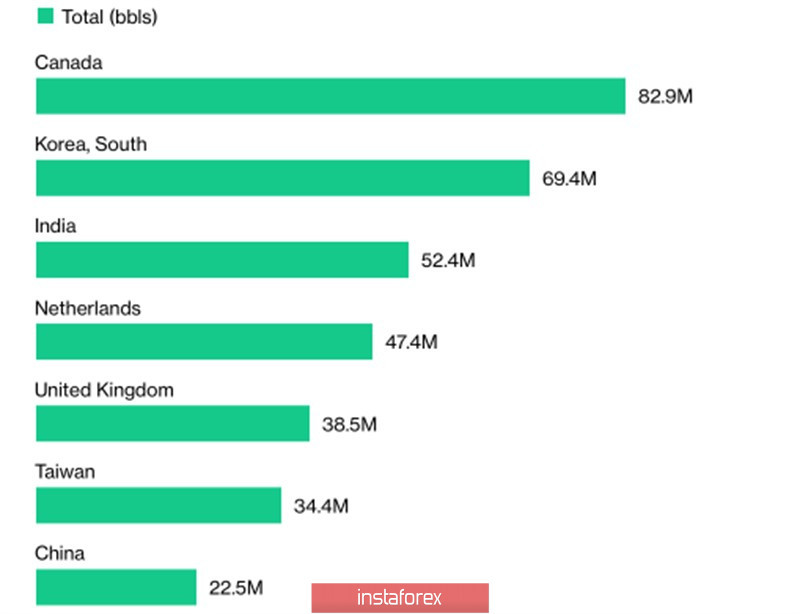

China's announcement that it will impose additional tariffs ranging from 5% to 10% on $75 billion in US imports left Brent and WTI in shock. China has repeatedly threatened to answer with an eye for an eye, a tooth for a tooth at Donald Trump's tricks, but few expected this from him! At the same time, Beijing introduced a 5% duty on the purchase of US oil. For local companies, this means + $3 per barrel for a Texas variety, which makes contracts unprofitable. The volume of black gold shipped from the United States declined as the trade conflict developed. Currently, China is the seventh buyer of oil produced in the United States.

US Oil Buyers

The tariff for the import of black gold from the United States and the growth of other duties will fall on the shoulders of American consumers, which allows us to predict a decrease in demand and a further increase in the already considerable reserves of 438 million barrels. There is an oversupply of oil in the US market, which leaves its mark on the global balance sheet and prices.

Fairly unpleasant news for the Brent and WTI bulls came from France, as Donald Trump announced his readiness to negotiate with Tehran during the G7 summit. Tensions in the Middle East, where tankers are seized from time to time, and Iran threatens to block the Strait of Hormuz, is good news for oil fans. If it disappears, OPEC is unlikely to be able to block the factor of reducing the growth in global demand by prolonging the agreement to reduce production.

However, it must be understood that the 19% peak of black gold from the highest levels of the current year improves the prospects for demand. The lower the price, the higher the interest in the asset. In this regard, further escalation of the conflict between the United States and China is unlikely to have the same devastating effect as before. Moreover, rumors circulated by Donald Trump about Beijing's readiness to resume negotiations lend a helping hand to Brent and WTI bulls.

Technically, on the daily chart of North Sea oil, the "Splash and Shelf" pattern is formed on the basis of 1-2-3. A consolidation range of $57.45-61.35 per barrel is being formed - the "shelf". A breakthrough of its upper boundary will create prerequisites for price growth to $66.25 (target at 88.6% according to the "Bat" model). On the contrary, a successful test of support at $57.45 will increase the risks of continuing the downward course to $54.3 (161.8% target for AB = CD).