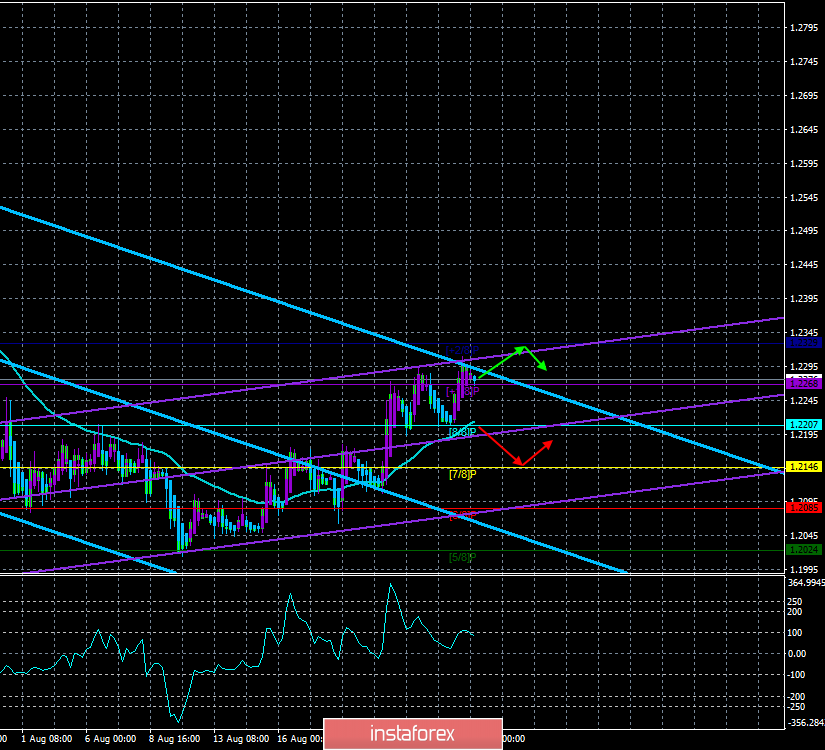

4-hour timeframe

Technical data:

The upper channel of linear regression: direction-down.

The lower channel of linear regression: direction – up.

The moving average (20; smoothed) – up.

CCI: 83.5583

As long as the pound continues to be resurrected, messages regarding the Brexit do not stop coming from the UK and the European Union. Firstly, according to many experts, Boris Johnson began to be taken more seriously in the European Union after his visits to Berlin and Paris and talks with Angela Merkel and Emmanuel Macron. The G7 summit also affected the change in attitude. Secondly, European diplomats (names are not given) are ready to consider any "realistic" proposals for a "backstop" on the Irish border, but they are not optimistic and do not believe that the British Prime Minister is able to offer anything worthwhile. Boris Johnson's authorized person, David Frost, is due to return to Brussels today, August 28, to continue negotiations with EU officials. Naturally, as noted by both sides, maximum efforts will be made to avoid the disordered Brexit on October 31.

Also last night, a telephone conversation took place between Boris Johnson and European Commission President Jean-Claude Juncker, in which Juncker reiterated that he would consider any proposals for a "backstop", but stressed that EU support for Ireland would continue. Juncker also added that the EU will make any necessary efforts to avoid a "hard" Brexit, but if it takes place, it will be the decision of the UK, not the EU. Johnson, in turn, once again said that the "deal" is impossible without the exception of the agreement clause on the "backstop".

What do we have in the dry residue? Nothing. There were regular talks, not negotiations, on the topic of Brexit between the leaders of the EU and Britain. Each of the parties remained in the opinion. The European Union said that it is ready to listen to proposals on the border on the island of Ireland, Johnson once again invited the European Union to simply forget about this problem. Nothing has changed. We believe that the talks between London and Brussels will not end with anything interesting. More interesting events will begin to develop in the near future in the British Parliament when it resumes its work after the summer holidays. It is the internal confrontation between Johnson and opponents of "hard" Brexit that will be decisive in the fate of Brexit.

From a technical point of view, the GBP/USD pair continues to strengthen purely due to technical necessity. Like any other currency, the pound cannot constantly fall. Now, it is a period of slight strengthening of the currency. However, at any moment, the fall can resume, you need to be prepared for this.

Nearest support levels:

S1 – 1.2268

S2 – 1.2207

S3 – 1.2146

Nearest resistance levels:

R1 – 1.2329

Trading recommendations:

The GBP/USD pair keeps the upward trend. Thus, today, purchases of the British currency with the target of 1.2329 remain relevant. It is not recommended to open a sell order earlier than a pound/dollar pair below the moving average line of a sell.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

In addition to the technical picture, fundamental data and the time of their release should also be considered.

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator regression window.

The moving average (20; smoothed) – blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.