The euro continued to decline amid uncertainty with the further policy by the European Central Bank, which requires a major change amid current events taking place on the world stage. Data on the German economy, which came out yesterday, showed a likely increase in the technical recession in the 3rd quarter of this year. Trade disagreements that persist between the US and China continue to affect the global economy, putting even more pressure on risky assets, forcing investors to pay attention to safe-haven assets.

It is possible that after the White House completes the trade conflict with the United States, the administration will return to duties on the eurozone.

As for yesterday's fundamental statistics, a good report on the US consumer confidence index supported the US dollar, which continued to strengthen its position after a sharp decline at the end of last week.

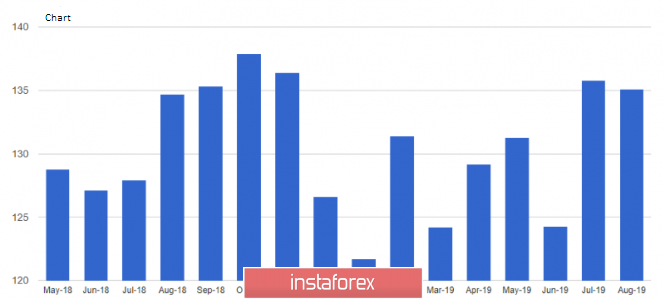

Despite the fact that tensions in foreign trade remain high, Americans have become less positive about their prospects. According to a report by the Conference Board research group, the consumer confidence index in August 2019 fell quite slightly to 135.1 points against 135.8 points in July, while many economists predicted that the index would decline more significantly, to 128.5 points. The expectations index fell to 107.0 in August, and the indicator of the current economic situation rose to 177.2 points.

A report from the US housing market, where price growth slowed again in June, points to the fact that the current low mortgage rates no longer provide the market with the necessary support.

By the way, yesterday's statements of the US President were again a message to the Federal Reserve System. Trump omitted the topic of trade conflicts and reiterated that the Fed seems to like to see manufacturers experiencing export problems while continuing to pursue a monetary policy that benefits only other countries. We are talking about high-interest rates in the United States compared to other countries.

As I noted above, the national housing price index S&P and Case-Shiller in June this year grew by 3.1% compared with the same period last year after annual growth of 3.3% in May. It should be noted that mortgage rates have fallen by about one percentage point since November 2018, but this has not stimulated demand for already expensive housing.

Manufacturing activity in the area of responsibility of the Federal Reserve Bank of Richmond in August continued to grow, albeit at a moderate pace. Support was provided by supply indices and new orders. According to the data, the Fed-Richmond composite manufacturing index rose to 1 point in August from -12 points in July. Economists had expected the indicator to drop to -5 points in August.

As for the current technical picture of the EURUSD pair, it remained unchanged compared to yesterday's forecast. Bulls will need a lot of effort to return to the resistance of 1.1120 and break above this range, as only after that it will be possible to talk again about the continuation of the growth of the euro to a maximum of 1.1160. A break of the support of 1.1080 will provide the bears with new forces, which will push the trading instrument into the region of August lows to the level of 1.1050.

GBPUSD

Meanwhile, the British pound is strengthening its position after a meeting of leaders of opposition parties in the UK, which took place yesterday. During the talks, the head of the Labor Party Jeremy Corbyn managed to enlist the support of representatives from the Scottish National Party, the Liberal Democratic Party and the independent group Change UK. It is a joint effort to resist Britain's withdrawal from the EU without an agreement.

As long as good Brexit news continues to appear on the market, traders will be wary of opening long positions on the pound.

As for the further growth prospects of the GBPUSD pair, the continuation of the growth requires a breakthrough of the resistance above the level of 1.2300, from which the bears will try to build the upper boundary of the new downward channel today. The breakdown of the level of 1.2300 will provide the trading instrument with the opportunity to update monthly highs in the area of 1.2350 and 1.2390. If the pressure on the pound returns, support will have a large level in the area of 1.2200.