GBP/USD

The last model on the pound chart was a flat bullish wave from July 30, which took the place of correction in a larger wave structure. The structure of the wave today looks complete. The price is in the area of a potential reversal. Since August 22, the chart began to form a counter movement with a reversal potential.

Forecast:

For pound purchases, conditions today are unfavorable due to the low expected upside potential. Over the next trading sessions, the completion of the current price increase, the formation of a reversal and the beginning of a price decrease are expected.

Recommendations:

For pound purchases, conditions today are unfavorable due to low expected potential recovery. In the area of the resistance zone, it is recommended to track the reversal signals to find the best conditions for selling points of the pair.

Resistance zone:

- 1.2290/1.2320

Support zone:

- 1.2220/1.2190

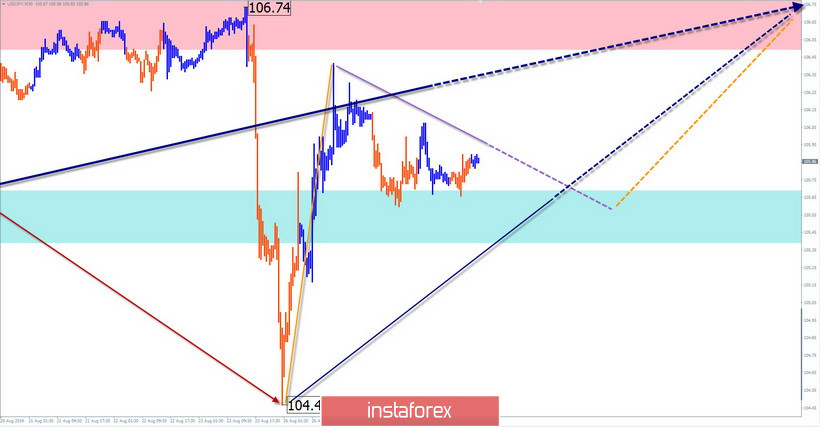

USD/JPY

The last unfinished wave structure on the chart of the Japanese yen is upward, from August 6. The wave claims the place of correction of the last trend area. Its structure is irregular. The final part (C) is formed in it. On August 26, the ascending section started up.

Forecast:

There is a high probability that the beginning of the increase will give rise to the final phase of the current wave. In the first half of the day, a flat mood of the price movement is expected, with an attempt to pressure the support zone. By the end of the day, the chance of changing the rate and raising the course of the pair to the resistance zone increases.

Recommendations:

Today, the sale of the yen is possible only when trading within the session. At the same time, it is more reasonable to reduce the lot and be ready to close the deal at the first reversal signals. It is recommended to focus on the emerging signals of buying the instrument.

Resistance zone:

- 106.50/106.80

Support zone:

- 105.70/105.40

USD/CHF

The last wave structure of the Swiss franc is ascending in the short term. It originates on June 25, has the form of a lateral plane. In the wave structure, a complex internal correction (B) has recently been completed. The price rise that began on August 26 has a reversal potential.

Forecast:

In the upcoming session, you can expect a short-term reduction in the price, with the flat nature of fluctuations. By the end of the day, the likelihood of a reversal and a return to an upward movement rate increases. A puncture of the lower boundary of support during a course change cannot be completely ruled out.

Recommendations:

The safest tactic today would be to refrain from trading during the upcoming pullback. In the area of the support zone, it is recommended to pay attention to the buy signals of the pair.

Resistance zone:

- 0.9860/at 0.9890

Support zone:

- 0.9800/0.9770

Explanations to figures: Waves in the simplified wave analysis consist of 3 parts (A-B-C). Analyzes the last unfinished wave. Zones show the areas with the highest probability of reversal. Arrows indicate the wave count used by the author to the method, a solid background structure for determining the expected movement.

Attention: The wave algorithm does not take into account the length of time the instrument moves.