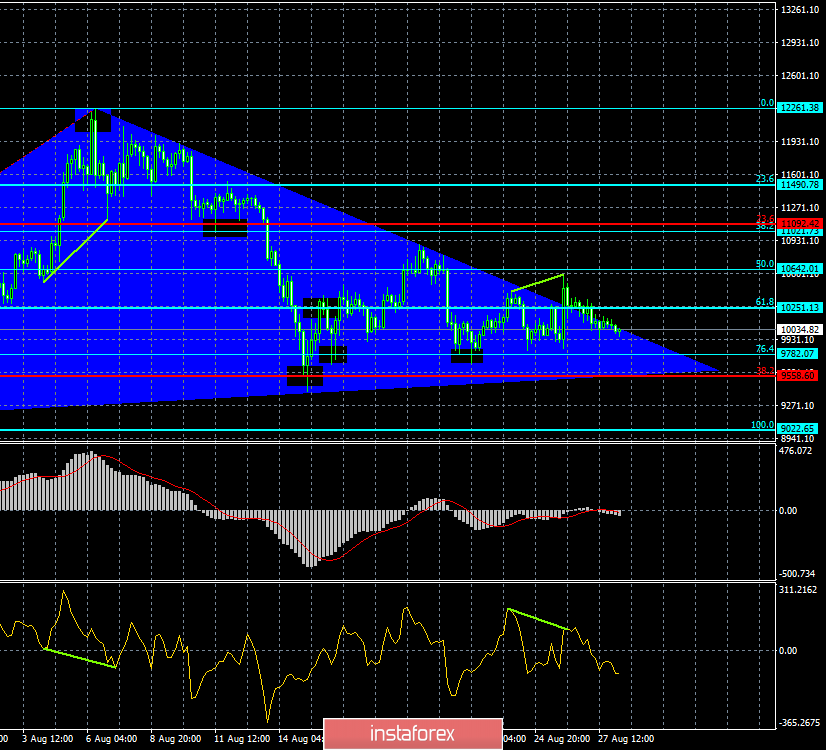

Bitcoin – 4H.

I have repeatedly written that Bitcoin, like other cryptocurrencies, is mainly used for profit. Its main stated function – a means of anonymous payments – is used for illegal operations, but the share of such operations in the total is negligible. For example, according to research, the US dollar is much more often used for illegal operations. Thus, in the current conditions, the main attraction of the "cue ball" for users is the possibility of obtaining a "quick profit". However, as recent studies show, more than a third of all bitcoin coins are concentrated in the hands of only 1,600 holders. Another part of bitcoins is considered irretrievably lost since access to wallets with coins was lost by their owners or for other reasons. Everyone remembers the story of buying pizza for 10,000 BTC. Thus, a small number of investors can theoretically have a serious impact on the rate of "cue ball", since the market laws of supply and demand have not been canceled. Increasing supply – has fallen off the rate of BTC, the reduction will create shortages and increase prices. And it turns out that the proposal can be manipulated by a small group of investors. A whole army of "experts" and "cryptanalysts" to shout on all corners that bitcoin will soon grow to $50,000 to $250,000 in order to foster interest from one-day investors, forcing them to buy Bitcoin, which will increase the cost of cryptocurrency and increase in the value of already purchased bitcoins, concentrated and crypto-tycoons on hand. By the way, according to other data, about 3% of wallets own 95% of the total number of bitcoins. This 3% group of people can create a deficit, which will lead to an increase in the price in the future, although the very essence of bitcoin will not change, its value will not change, and the price increase will be due only to an artificial deficit.

The Fibo grid is based on the extremes of July 17, 2019, and August 6, 2019.

Forecast for Bitcoin and trading recommendations:

Bitcoin performed consolidation under the Fibo level of 61.8% ($10251). Thus, I recommend selling cryptocurrency with a target of $9782, with a stop-loss order above the level of 61.8%.

I recommend buying bitcoin with a target of $10642, and with a stop-loss level of $10251, if the closing is performed above the correction level of 61.8%.