The British pound collapsed by more than 100 points on Wednesday after an interview with British Prime Minister Boris Johnson as he asked Queen Elizabeth II to allow Parliament to stop working for several weeks. We are talking about a complete suspension of the work of Parliament, supposedly in order to develop a new program on Brexit, which was discussed last week with representatives of the European Union.

However, it is clear to many that such actions of the prime minister, of course, are not aimed at developing a program, but are a kind of response to opposition legislators in order to complicate their work related to blocking proposals for Brexit. First of all, such measures will reduce the time required for lawmakers to draft and adopt bills that prevent Britain from "divorcing" the European Union without an agreement.

According to the report, the prime minister intends to stop current Parliamentary session on September 11, and resume work only on October 14. The UK exit from the EU should happen on October 31.

Opposition lawmakers immediately criticized the plan to suspend Parliament, as Johnson's appeal to the Queen makes Brexit more likely without an agreement, which hit the British pound. If in the first half of the day traders cautiously bought the British pound, now only Queen Elizabeth's refusal can return their faith in growth.

EURUSD

The euro continued to trade near the support level of 1.1080 in the morning. Pressure on risky assets continued even after the report that consumer sentiment in Germany in September this year will remain at a high level. According to a report by the GfK research group, the leading GfK consumer confidence index in September 2019 was 9.7 points, while economists expected it to decline to 9.6 points.

Gfk cited the fact that domestic demand will continue to remain at a fairly high level in the coming months, which will provide support in the face of a slowing economy.

Another not very good news for the ECB was the less active growth of lending to the private sector, while the growth of the money supply in the region increased.

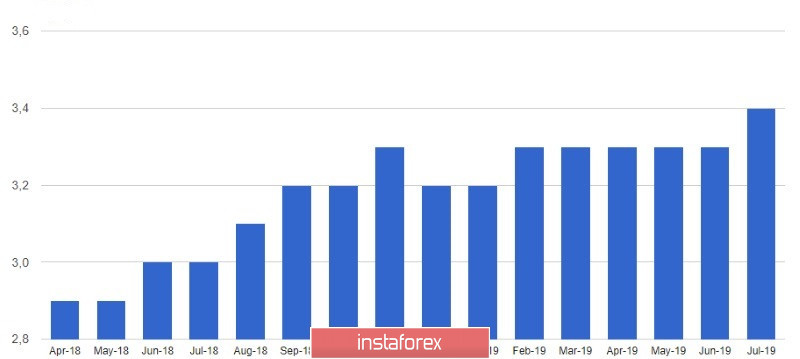

According to data, lending to companies in the eurozone grew by 3.9% in July compared with the same period last year, and lending to households accelerated to 3.4% from 3.3% in June. Economists expected more active growth in private sector lending. Eurozone money supply indicator M3 grew by 5.2% in July, while economists had expected growth to reach 4.8%.

The technical picture remained unchanged. Bulls will need a lot of effort to return to the resistance of 1.1120 and break above this range, since only after that it will be possible to again discuss the topic of continuing the euro's growth to a peak of 1.1160. A break of support of 1.1080 will provide bears with new forces, which will push the trading instrument into the region of August lows to the level of 1.1050.