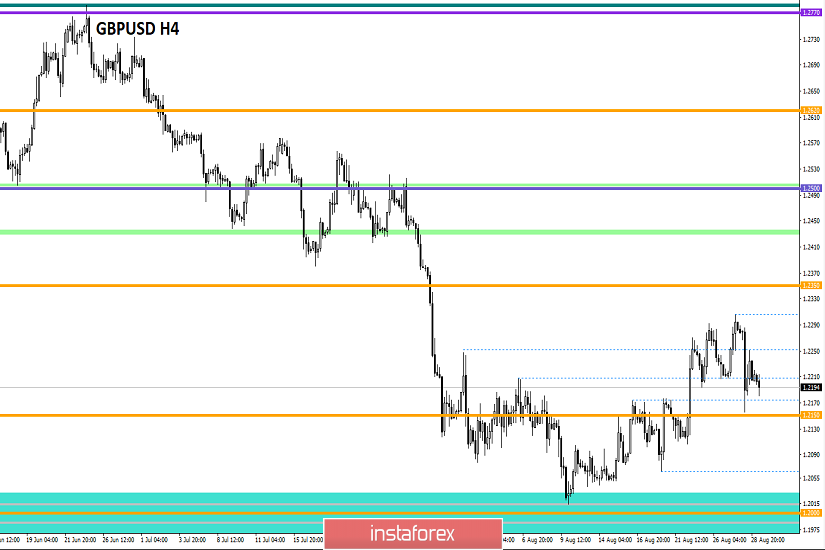

Over the past trading day, the pound / dollar currency pair showed a high volatility of 133 points against the background of a surge in the information flow. From the point of view of technical analysis, we see a sharp shot down, where the pound lost more than 100 points in a matter of hours. The reason lies precisely in the information background, which we will talk about a little later. This kind of move was temporary, but still he managed to lower us to the area of 1.2150, which we, in principle, expected, but not in such a short period of time. Local overheating of short positions turned out to be fatal, and as a result, a rapid recovery followed by a slowdown in the region of the control point 1.2200, which in history served as a mirror level.

As discussed in the previous review, traders were in no hurry to act. The task was to analyze the behavior of the quotation relative to the boundaries of 1.2250 / 1.2300, but as soon as there was a sharp drain, everyone woke up without exception. Aggressive market participants first flew into the market, which was certainly the right step. The point of 1.2250 was passed by a characteristic strong candle, and then followed by a profit. The exit points, in this case, almost coincide perfectly with our earlier forecast. Considering the trading chart in general terms, we see that the impulse yesterday was strong, but the tact of correction is still preserved in the market. In turn, the main downward trend remains unchanged, and the prerequisites for its change have not yet been observed.

The news background of the past day was indecently empty. Complete statistics were not published for any country, but the information background, of course, did yesterday. So what happened? The British Prime Minister asked Queen Elizabeth II to suspend the work of the British Parliament from September 9 to October 14 and two weeks before Brexit, so that the deputies would not interfere with the Prime Minister to complete the work. The request was approved by the Queen, and as a result of which, the pound went into free fall. This kind of step to close the parliament has not been used since the Second World War; it certainly scares everyone without exception. In turn, the British opposition quickly responded to Johnson's extreme move, pouring a sea of criticism on him.

"I am shocked by the irresponsibility of Johnson's government, which speaks of sovereignty and at the same time intends to suspend the work of parliament in order to avoid careful control over its crazy plan to leave the EU without a deal. This is a gross violation of the law and a threat to our democracy, "Jeremy Corbyn outlined his position in the media.

In turn, widespread panic was almost instantly reflected in the streets of London, where protests of such radical actions by the government began.

In the current development, the opposition is trying to put as much pressure on the public as possible to expose the current government and prevent Boris Johnson from taking radical steps.

Labor leader stimulates the public with criticism, even touching on the theme of friendly relations between Johnson and Trump.

"I think the US president means that Boris Johnson is exactly what he was looking for. An accommodating prime minister who would give British social services and guarantees to American corporations under a free trade agreement," via Twitter Jeremy Corbyn @jeremycorbyn

Today, in terms of the economic calendar, we have preliminary data on the United States GDP for the second quarter, where the second estimate expects a slowdown to 2.2%. Of course, such news may affect the dollar in the form of its weakening. However, the strongest information background puts pressure on the British currency, and now, I'm not sure that the news on GDP will have the proper effect.

Further development

Analyzing the current trading chart, we see that the short-term pullback, after a sharp decline, again went downhill, reflecting the general panic mood and the strong pressure of the information background. Traders, in turn, have already managed to earn lower, but work with short positions is still ongoing in terms of returning quotes to 1.2150.

It is likely to suggest that it would be most logical to see stagnation within 1.2180-1.2240, but in the event of a worsening situation in Britain, a decline is inevitable. The first point in terms of reduction is the same level of 1.2150. After which, it is worth analyzing the fixation points relative to this coordinate. When setting up an analysis, the information background, should be carefully evaluated since it will play a key role in this case.

Based on the above information, we derive trading recommendations:

- Buying positions: while we refrain from recommendations, we need some kind of obvious positive in terms of background or another overheating of short positions.

- Sales positions are considered lower than 1.2170, with the prospect of a move to 1.2150 (the first point) and, in case of fixing below, the extension of the position to 1.2080.

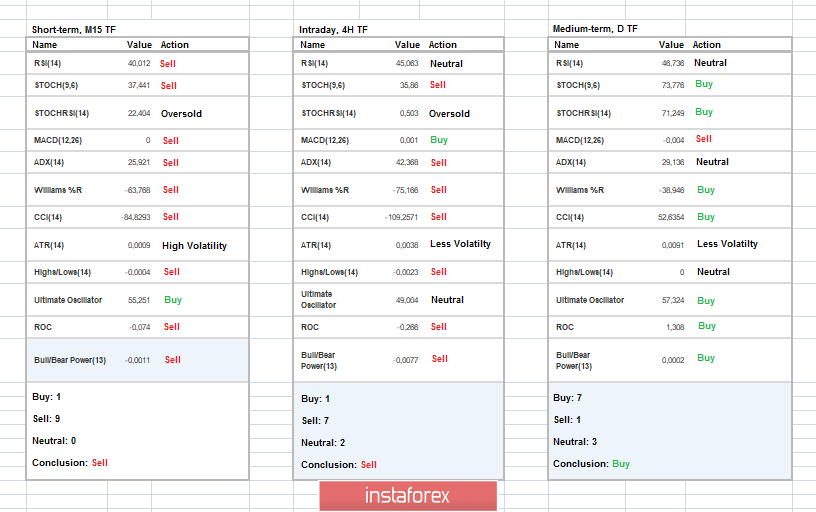

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that indicators in the short and intraday are prone to decline due to recent surges in prices. Meanwhile, the medium-term outlook is still under correction.

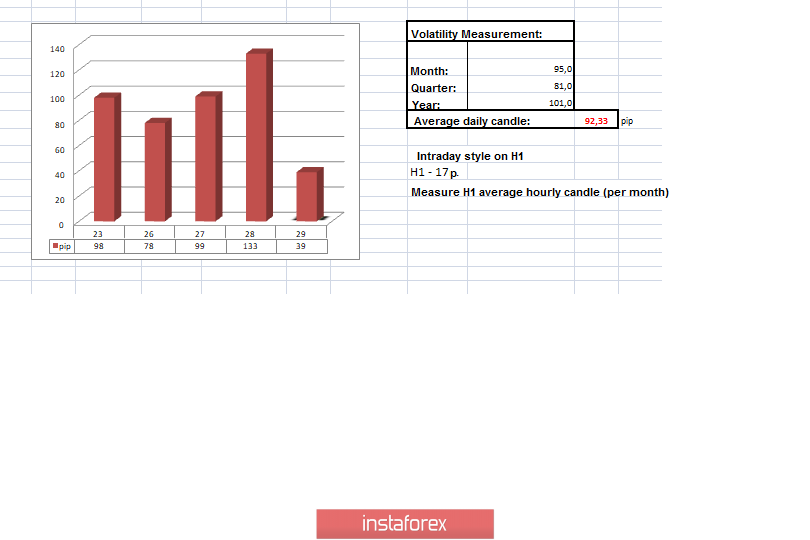

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(August 29 was built taking into account the publication time of the article)

Current time volatility is 39 points. It is likely to assume that in the case of maintaining the information background and the aggravation of the opposition, volatility may continue to grow.

Key levels

Resistance zones: 1.2350 **; 1.2430; 1.2500; 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) *; 1.2920 * 1.3000 **; 1.3180 *; 1.3300

Support areas: 1.2150 **; 1,2000; 1.1700; 1.1475 **

* Periodic level

** Range Level

*** The article is built on the principle of conducting a transaction, with daily adjustment