Japanese trap sellers

Trading idea for the USDJPY

Dear traders, please pay attention to the instrument, which has undeservedly forgotten recently. Everyone knows that the yen often acts as a funding currency, and during periods of crisis, turmoil, and political uncertainties, investors are very pleased to "sit out" in the yen. Thus, it happened this time. Trade wars and exchange of duties led to the strengthening of the Japanese currency against the dollar, and since the spring of this year, we have seen a good short-term trend for USDJPY.

However, this instrument is moving not only because of the strength of the yen, but also because of weak demand for the dollars in general. So, judging by the slowdown in the dynamics of MEGA-overbought gold, a wave of strengthening of the dollar is coming, which will lead to an upward trend in USDJPY as well as earning good money from it.

The technical picture

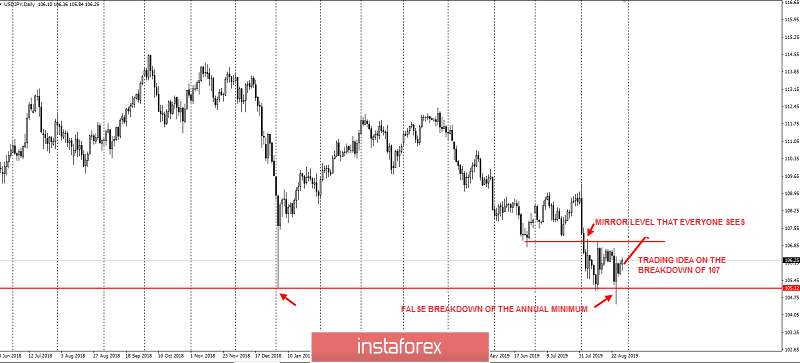

In August, the yen updated last year's minimum of 105 and rebounded - exposing a false breakdown in weeks.

From the point of view of D1, the pair formed an ideal level of support-resistance on the quote in the area of the round level 107. This level is a magnet for attracting sellers' stops according to the trend. However, few people know that the so-called "mirror" pattern works well from 1-2 touches, and the longer the market stands at an obvious level, the more likely it is considered as a BREAK.

As you know, I am a supporter of the "hunting for feet" method and I am deeply convinced that in most cases, everyone who puts their feet behind at obvious extremes and levels will sooner or later suffer losses. And the situation with the yen will not be an exception. Therefore, it is suggested to look at the long positions on USDJPY in order to update the level of 107.