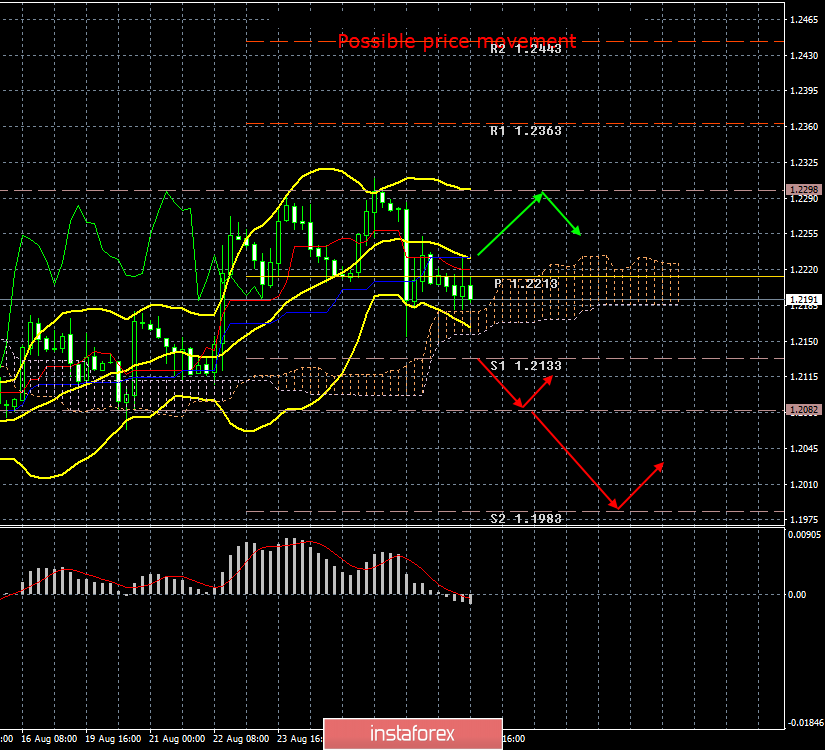

4-hour timeframe

Amplitude of the last 5 days (high-low): 63p - 164p - 100p - 78p - 134p.

Average volatility over the past 5 days: 108p (high).

Thursday, August 28, passed in a calm direction without sharp jolts for the GBP/USD pair. Volatility in the pound/dollar pair as a whole remains quite high, more than 100 points per day. Meanwhile, passions continue to rage in the UK around Boris Johnson's decision to stop Parliament from September 9 to October 14. This decision has already been approved by Queen Elizabeth II. Boris Johnson and his entourage reject the accusation that the suspension of Parliament has been started in order to prevent deputies from vetoing the secession from the EU without a "deal". The prime minister claims to have sent MPs on vacation for an additional 5 weeks to plan a new government program. Protests have already taken place across the UK. Most opponents of the hard Brexit are calling Johnson's actions "unconstitutional and undemocratic." Member of the Conservative Party (!!!) Philip Hammond says the following: "This is a gross constitutional violation - not to allow Parliament to control the government during a national crisis. The prime minister's deeply undemocratic decision." A petition has already appeared on the internet, which has gained more than a million signatures in a day, demanding not to allow the Parliament to stop working. Observance with the principle of "democracy" is indeed called into question by Johnson's actions. It turns out that when democracy comes to a standstill (the three proposals rejected by Parliament for Theresa May's "deal"), it can easily be circumvented with the help of the Queen, who usually does not interfere in political issues. Labour and opposition leader Jeremy Corbyn said Johnson's actions were undemocratic and promised at a Parliamentary meeting that he would endorse a vote of no confidence in the prime minister. According to promptly conducted surveys, only 27% of respondents support Boris Johnson's decision to suspend Parliament. At the same time, the leader of the British House of Commons, Jacob Rees-Mogg, stated that the decision on new negotiations on a "deal", or "divorce", without any agreements lies entirely with the European Union. Rees-Mogg also rejects any allegations that the decision of Boris Johnson deprives the deputies of the opportunity to stop the chaotic exit from the EU. After October 14, Rees-Mogg believes, MPs will be able to speak out about this. The fact that October 14 will remain 2 weeks before Brexit is not taken into account in all seriousness.

What this all means for the pound is clear to everyone. It is surprising that the British currency did not fall under a mass sell-off today. Probably, market participants still want to wait for the first Parliamentary meetings before the new "recess" and watch the actions of Jeremy Corbyn and the opposition. If Johnson doesn't succeed, the pound will almost completely go to a new lingering decline.

The technical picture shows that so far the pound retains chances not to increase, but not to resume the fall. Below, the British pound is supported by the Senkou Span B strong line and the support level of 1.2133. If bears manage to overcome these supports, the British currency will continue to fall.

Trading recommendations:

The pound/dollar currency pair continues to adjust. Formally, long positions can be considered while aiming for the resistance level of 1.2298 if the pair returns above the Kijun-sen critical line. However, the fundamental background clearly does not imply the purchase of the British currency.

In addition to the technical picture, fundamental data and the time of their release should also be considered.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.