The single European currency's hopes for weak US statistics did not materialize, and the dollar continued to strengthen its position for this reason. Although the data on applications for unemployment benefits were clearly not encouraging. Thus, the number of initial applications for unemployment benefits increased from 211 thousand to 215 thousand, and repeated ones, from 1676 thousand to 1,698 thousand. At the same time, the number of repeated applications for unemployment benefits should have increased to 1680 thousand, so the data turned out to be slightly worse than forecasts. However, the attention of market participants was not focused on the data on applications for unemployment benefits, but on the second estimate of GDP in the second quarter. And if the first estimate showed a slowdown in economic growth from 2.7% to 2.3%, then the second estimate expected an even greater slowdown, to about 2.2%. The calculation was made specifically for a stronger slowdown in economic growth, which would have made it possible to double talk about an impending recession in order to force the Federal Reserve to lower the refinancing rate. However, the data disappointed all supporters of a softer monetary policy, as they confirmed the first estimate and showed a slowdown in economic growth to 2.3%. So this had no effect, since such a situation has long been taken into account by the Fed. Moreover, the first estimate of GDP for the second quarter was published before the Federal Open Market Committee decided to lower the refinancing rate from 2.50% to 2.25%. In other words, nothing has changed, and there are no additional reasons for a possible reduction in the refinancing rate, which means that investors will continue to proceed from the current disparity in interest rates.

Today, the attention of market participants will shift to Europe, where unemployment data is published, as well as preliminary data on inflation. Almost certainly, the unemployment rate will remain unchanged, that is, at around 7.5%, but inflation is not the most interesting. Just yesterday, forecasts showed that preliminary data would show inflation acceleration from 1.0% to 1.1%, which could slightly change things, as such a development of events would reduce the desire of the European Central Bank to somehow soften its monetary policy. However, forecasts were revised, and now they no longer expect any increase in inflation. It's good that they do not expect its decline. In any case, once again, the overall picture does not change at all, so the notorious disparity in interest rates that investors are guided by remains the same.

Inflation dynamics in Europe:

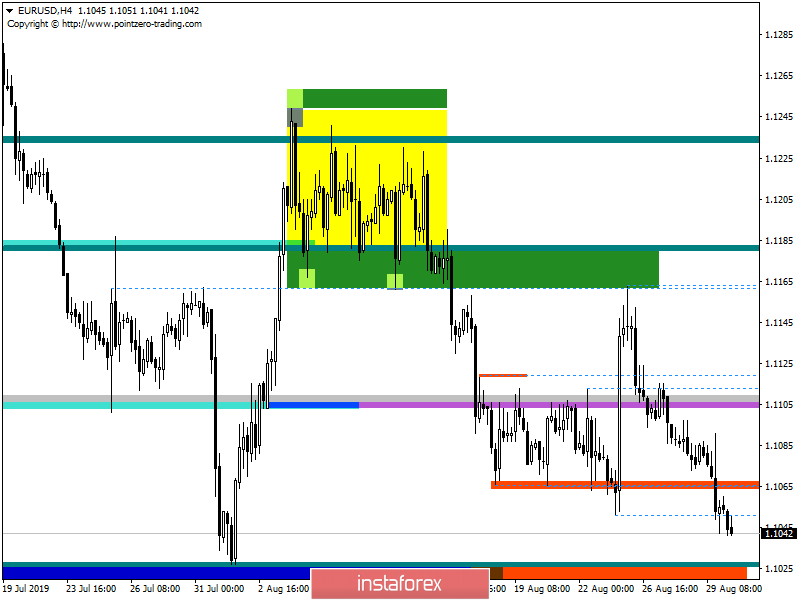

Since the beginning of the week, the EUR/USD pair has taken a recovery position, recouping as a result of last Friday's impulse and falling within the psychological level of 1.1000. Considering everything that happens in general terms, we see that the downward interest occupies a leading position in the market, and the trend is only one level of 1.1000, which holds it back from further decline.

It is likely to assume that a control rapprochement with the psychological level of 1.1000 is possible, but whether the quotation will be able to break through it remains a question. A type of assumption is considering temporary deceleration with a subsequent correction, relative to the level, but with the preservation of the general downward trend.

Concretizing all of the above into trading signals:

• We consider long positions if we find a point that supports within the psychological level of 1.1000 (+/- 30p).

• Short positions directed towards 1,1000 (+/- 30p).

From the point of view of a comprehensive indicator analysis, we see that the indicators at all the main time intervals signal an increased downward interest. It is worth considering that if a variable support is found, the first deceleration signal will be displayed on the indicators of a smaller time frame.