Talks about the resumption of trade negotiations between the US and China, as well as the serious package of macroeconomic statistics, (including data on foreign and retail trade, GDP) and the meeting of the Reserve Bank, are forcing investors to look closely at the Australian dollar. In late August, he was marked by a fall to a 10-year-old bottom relative to his American namesake but the situation could change in September.

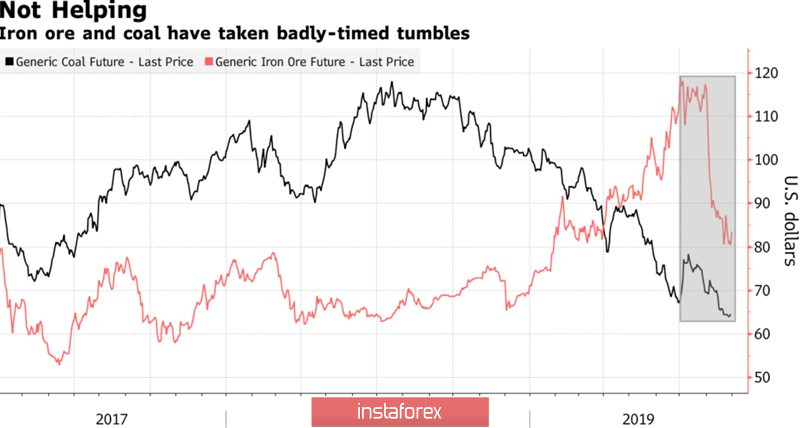

The green continent can get rid of the double deficit, budget and current account for the first time since 1975 and the reasons for this must be sought in the rapid growth of the assets of the commodity market and the devaluation of "Aussie". Over the past 12 months, the AUD/USD pair has lost about 7% of its value. At the same time, iron ore soared in the spring to the level of $120 per ton, which was the maximum for several years. Budget revenues increased and export earnings.

Dynamics of coal and iron ore

Improving the state of the budget and foreign trade is one of the important arguments in favor of a pause in the process of monetary expansion of the RBA. In June and July, the Reserve Bank lowered its basic interest rate to a historically low level of 1%, and now it needs to see how the economy of the Green Continent responds to the weakening of monetary policy. The derivatives market believes that the pause will be short-lived (by March 2020), the cash rate may drop to 0.5% amid continuing trade tensions between the US and China. The Central Bank itself does not exclude a fall in borrowing costs to 0.25-0.5% and the area from which, its colleagues from the United States, Canada and Britain usually began to raise rates. Nomura believes that there is a 40% chance of using unconventional monetary policy measures, including an asset purchase program.

In August, iron ore prices were the worst dynamics in history due to a reduction in demand from Chinese consumer plants and a solution to supply problems from Brazil. This circumstance, coupled with the escalation of the conflict between Washington and Beijing and the RBA's intention to continue to weaken monetary policy, made the outsider G10 out of the Australian dollar. Only the Scandinavian currencies and the "New Zealander" look worse than him, whose Central Bank decided to reduce the rate by 50 bp immediately during one meeting.

Despite the fact that RBA deputy governor, Guy Debelel, believes that AUD/USD pair may fall to 0.5 due to external factors, improving the economy of the Green Continent and increasing the sensitivity of US GDP to trade wars can help fans of the "Australian" find the bottom. In particular, the passivity of the Reserve Bank in September, strong data on the gross domestic product of the Green Continent and weak statistics on the American labor market can lead to an increase in the analyzed pair.

Technically, the harmonious trading patterns AB=CD and "Shark" signal that the pair may collapse to 0.6 and 0.53 on the monthly AUD / USD chart. However, in my opinion, this will require a recession in the US and a significant slowdown in the Chinese economy. If the bulls manage to close September above 0.685, the risks of correction will increase.

AUD / USD monthly chart